Does Your Company Require a Statutory Audit?

All companies in Ireland must prepare annual financial statements. It’s a statutory requirement to file those financial statements with the Companies Registration Office (CRO) along with your Annual Return. For many companies, there is also a statutory requirement for annual financial statements to be audited.

Does your company require a statutory audit? There are a number of rules that apply, but for most businesses, you will need a statutory audit unless your company qualifies for an exemption as a small company, small group, or dormant company.

In this blog, we will give an overview of statutory audit requirements in Ireland, including the criteria that apply to qualify for an audit exemption. We’ll also look at what happens if your company is part of a group, as well as the types of companies that cannot qualify for an audit exemption.

We are going to start with the latter category – the types of companies that must go through the statutory audit process every year, regardless of their size or status.

Companies Ineligible for Statutory Audit Exemption Status

There are three main types of statutory audit exemption in Ireland:

- Small company audit exemption

- Small group company audit exemption

- Dormant company audit exemption

Criteria apply to all three, but there are some types of companies that are not entitled to any of the exemptions. For the following types of companies, statutory audits are required every year:

- Public limited companies

- Public unlimited companies

- Investment companies

- Credit institutions

- Insurance undertaking

- Companies referred to in the Fifth Schedule of the Companies Act 2014

The last point is a complex area that only applies to certain types of companies in Ireland, such as those in the financial and insurance sectors. More information is on the government’s electronic Irish Statute Book (eISB) website. It is also advisable to speak to a chartered accountant for advice specific to your circumstances.

Qualifying for a Small Company Statutory Audit Exemption

Your company can be classified as exempt from statutory audit requirements if it qualifies as a small business. For that to be the case, at least two of the following three criteria must apply:

- You have an annual turnover of less than €15m

- Your balance sheet total is less than €7.5m

- Your employee headcount averages less than 50 over the year

Another condition is that you must file your annual returns on time. If your company has filed a late return and has also been late in one of the previous five years, you will lose your statutory audit exemption for two years. In other words, you get a chance if the late filing is a one-off. But if you file late twice over a period of five years, you will (temporarily) lose small company statutory audit exemption status.

As well as being audit exempt, small companies can also file abridged financial statements with their Annual Return rather than full financial statements.

Qualifying for a Small Group Company Audit Exemption

Any company that is part of a group can qualify for a statutory audit exemption if the whole group meets the small group criteria. To meet the small group criteria, at least two of the following conditions must be met by the group as a whole:

- The entire group has an annual turnover of less than €15m

- The entire group has a balance sheet total that is less than €7.5m

- The employee headcount of the entire group averages less than 50 over the year

The above conditions must be met in both the current and previous years.

Dormant Company Statutory Audit Exemption

Dormant companies can qualify for a statutory audit exemption if both of the following conditions apply:

- There have been no significant accounting transactions over the year.

- Assets and liabilities can only be from permitted categories.

How to Claim a Statutory Audit Exemption and Points to Consider

To claim an audit exemption, you must include an audit exemption statement when filing your Annual Return with the CRO.

Additional points to consider include:

- Even if you qualify for a statutory audit exemption, other parties might still ask for an audit. Your bank, for example, or a trade organisation.

- All shareholders with 10 percent or more of the company’s voting rights must agree to the request for statutory audit exemption.

- While the rules outlining the types of companies that can qualify for a statutory audit exemption are clear, the application of those rules can be complex. It is always best practice to get expert advice from a chartered accountant to confirm whether your business requires a statutory audit or can qualify for one of the exemptions.

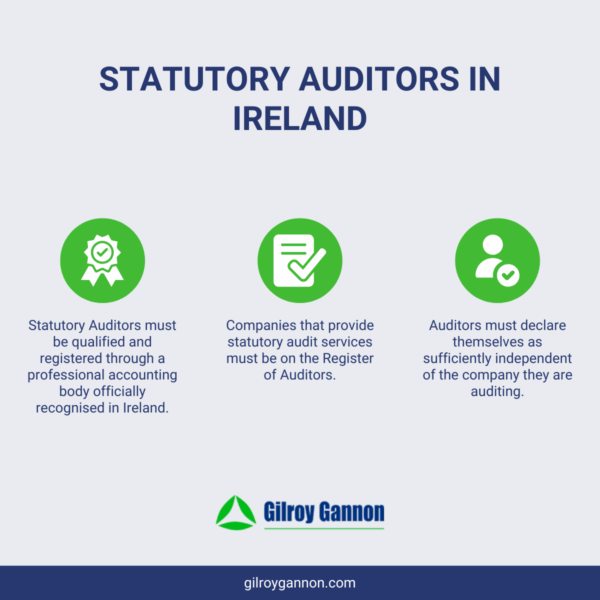

Statutory Audit Advice and Support from Gilroy Gannon

To find out more about the statutory audit process, to get advice on your exemption status, or for statutory audit services, please get in contact with us at Gilroy Gannon to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.