What You Need to Know About Payroll in Ireland

Getting to the stage of hiring employees is an important milestone for any business. It also adds a huge administrative and compliance burden, as the rules around payroll and paying employees are both complex and strict.

This guide will give you an overview of the main points in relation to payroll, but the best advice is to speak to an accountant. Your accountant will be able to factor in all the variables at play, including the position of your business, the personal circumstances of employees, and anything else that applies.

Overview of PAYE

The payroll system in Ireland is based on PAYE – Pay As You Earn. In simple terms, PAYE makes it the employer’s responsibility to calculate and pay income tax on behalf of their employees.

It’s not just income tax either, as employers are also responsible for paying PRSI and USC.

- PRSI – PRSI is Pay Related Social Insurance. It funds the social welfare system in Ireland.

- USC – USC is the Universal Social Charge. It is an additional, progressive income tax, so it impacts higher earners more than lower earners.

Key Elements of Irish Company Law

Payroll rules, regulations, and requirements are only one aspect of employing and paying staff in Ireland. The following key elements of Irish company law also apply:

- Minimum wage

- Rules around working hours

- Annual leave

- Public holidays

- Sick pay

- Maternity and paternity pay

Payroll Frequency

One of the main decisions you will need to make when you first hire staff is how often you will pay them. Common payroll frequencies include weekly, fortnightly, or monthly.

Paying less frequently reduces the time you need to allocate to payroll as you will have less of an administrative burden. If you outsource payroll, paying staff monthly will cost less than paying weekly or fortnightly.

Whatever payroll frequency you choose, staff are usually paid in arrears. Paying in arrears reduces the risk of errors and can help with cash flow.

Understanding Gross Pay

Gross pay is the total that an employee is paid before any deductions (such as income tax). As a result, gross pay includes:

- Salary/wages

- Notional pay (benefits in kind, such as a company car or company-paid private health insurance)

- Bonuses and commission

- Overtime

- Holiday pay

An Overview of Payroll Deductions

Income Tax

The Irish tax system has a two-tier tax rate structure that includes a standard rate of income tax and a higher rate.

The standard rate is 20% and applies to income up to €44,000 for a single person and €53,000 for married couples and civil partners. The higher rate of 40% applies to earnings above the standard rate thresholds.

Tax credits reduce the tax liability of employees. Most employees will have a personal tax credit and an employee tax credit that will apply.

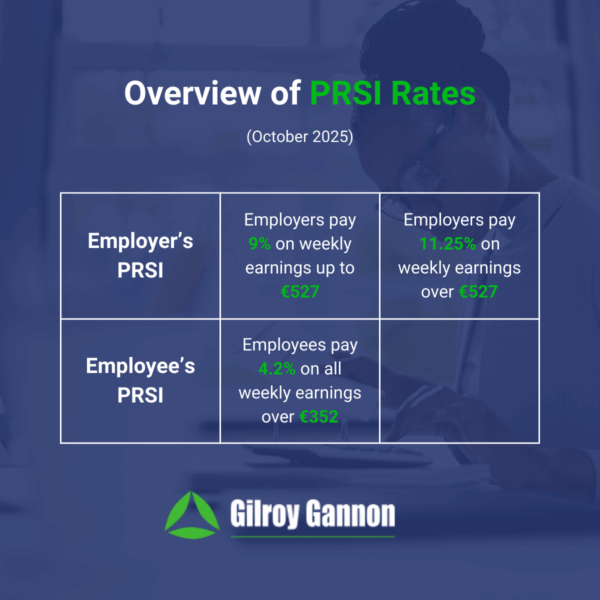

PRSI

PRSI is paid by both employees (on earnings above a specified threshold) and employers. The amount of PRSI that is paid is based on a percentage of the employee’s earnings. So, the more an employee earns, the more PRSI is paid by both the employee and the employer.

It is important to consider PRSI when hiring staff, as you will pay it as well as the employee. This means the cost of an employee is not just their annual salary. It is their annual salary plus employer PRSI.

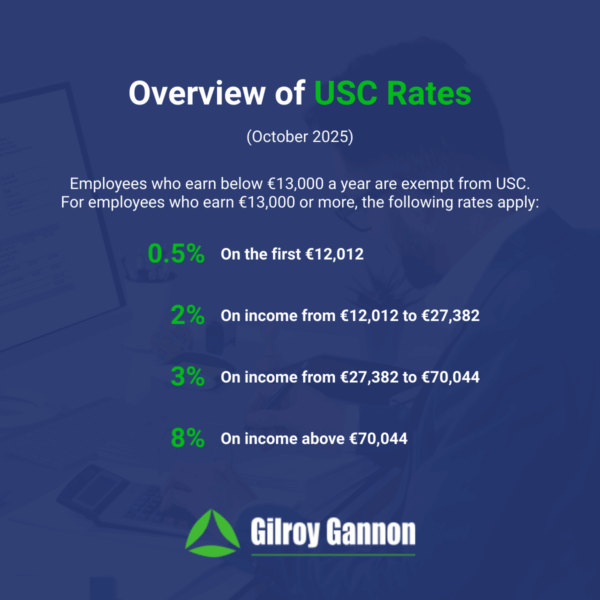

USC

USC is paid by employees once they earn above a certain threshold, currently set at €13,000 a year. The rate of USC increases the more that employees earn.

Local Property Tax

Employees who own property can choose to pay local property tax through the PAYE system.

The Process for Registering as an Employer

If you employ people, you must register as an employer with the Revenue. This involves completing a form to provide your name, address, and other information related to employing staff.

The easiest and most cost-effective way of registering as an employer is through the Revenue Online Service (ROS).

Payroll Software

You will need payroll software to process payroll. There are a lot of options available, but the best advice is to choose one that connects directly to ROS. This will make it easier to process payroll and interact with the Revenue.

Payroll Compliance Considerations

The Revenue operates a real-time reporting requirement for payroll. This means you must report to the Revenue the pay of employees and any statutory deductions (income tax, PRSI, etc) on or before the date you pay staff.

Your PAYE returns and payments must be made by the 23rd of the following month when you file online (by the 14th if you file on paper).

It’s also important to remember that you should keep payroll documentation for at least six years. This includes income tax, PRSI, and USC deductions, as well as employee information, payment calculations, work hours, and holiday pay.

Steps for Processing Payroll

- Start the process in your payroll software. This will include entering the hours worked, bonuses, and any other relevant information for each employee.

- Submit the required information to the Revenue. Your payroll software will usually handle this part of the process.

- Pay your employees, usually by bank transfer.

- Give your employees their payslips, typically by email.

Benefits of Outsourcing Payroll

As mentioned at the start of this blog, payroll is complex. It is also a constantly evolving process, as laws, regulations, and thresholds change frequently. This includes relevant payroll elements such as the minimum wage in Ireland, thresholds for the higher rate of income tax, and PRSI rates.

This complexity (and the risk of getting it wrong) can be reduced by outsourcing payroll. The main benefits of outsourcing payroll include:

- Reduce the administrative burden, freeing up time for other tasks in your business. After all, payroll is an essential but non-core function in most businesses.

- Ensure compliance and reduce the risk of penalties and additional scrutiny from the Revenue.

- Ensure accuracy to save time correcting mistakes, especially mistakes that cause stress for your staff.

- Get expert advice on all aspects of tax and paying staff.

- Easier to scale as your business grows.

- Can be bundled with other services to enhance ROI.

Support from Gilroy Gannon

Whether you need expert advice or you want to outsource payroll, we can help at Gilroy Gannon. From getting you set up as an employer to managing regular payroll tasks, you can rely on our team. Get in touch today to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.