Irish VAT Rates Explained

VAT, or Value Added Tax, is a consumption tax. It is applied to the sale of most goods and services in Ireland at each stage of the supply chain, from production to the final sale to the consumer. It is charged as a percentage of the sales price and is collected incrementally by VAT-registered businesses who pay it to the government.

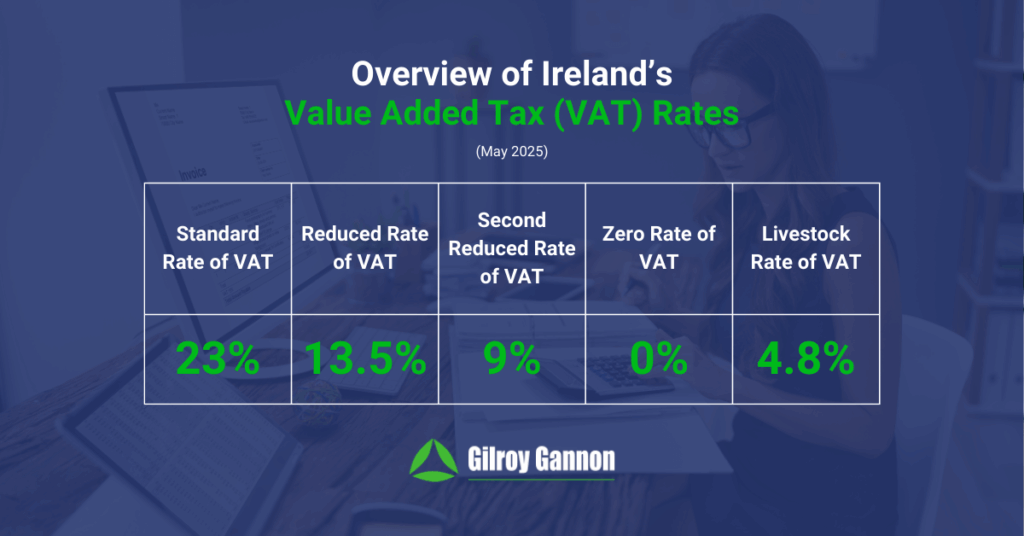

There are five main rates of VAT in Ireland:

- Standard rate

- Reduced rate

- Second reduced rate

- Zero rate

- Livestock rate

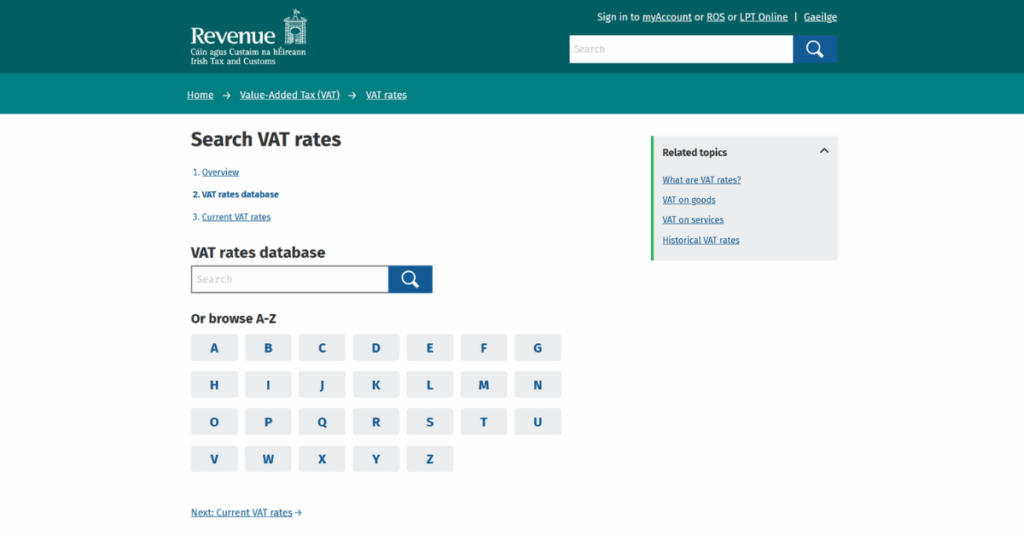

VAT Rates Database

A brief guide to each VAT rate can be found below. To find the exact rate of VAT for the goods or services you sell, you should check the VAT rates database on the Revenue’s website.

Irish VAT Rates

Standard Rate of VAT

The standard rate of VAT in Ireland is 23%.

The standard rate of VAT applies to all goods and services that don’t fall into one of the other rates. This covers most goods and services sold in Ireland.

Reduced Rate of VAT

The reduced rate of VAT in Ireland is 13.5%.

The reduced rate of VAT applies to specified goods and services including most cleaning, maintenance, and repair services, as well as short-term car hire. Coal and home heating oil are also subject to the reduced rate of VAT. Some hospitality and leisure services are also subject to the reduced rate of VAT, including cinema tickets and most food sold in restaurants.

Second Reduced Rate of VAT

The second reduced rate of VAT in Ireland is 9%.

The second reduced rate of VAT applies to some goods and services such as printed brochures and programmes.

Zero Rate of VAT

The zero rate of VAT in Ireland is 0%.

The zero rate of VAT applies to a limited list of goods and services, including exports. Some food and drink products qualify for the zero rate of VAT, including tea, coffee, and milk. The zero rate of VAT also applies to books and clothing for children under 11.

Livestock Rate of VAT

The livestock rate of VAT in Ireland is 4.8%.

The livestock rate of VAT applies to most sales of livestock.

Goods and Services that Are Exempt from VAT

In addition to the main rates of VAT in Ireland, there are also specified services that are exempt from VAT.

The main difference between zero-rated and VAT-exempt services is down to reporting and whether or not your business can reclaim VAT. If your business supplies zero-rated goods or services (or goods or services subject to one of the other Irish VAT rates), you must report them on your VAT return, and you can claim VAT back on your business-related purchases. If you only supply goods or services that are VAT-exempt, you can’t claim VAT back.

Examples of services that are exempt from VAT include live music performances, educational services, financial services, and medical services.

How VAT is Charged

VAT is charged each time the cost of a product increases.

For example, let’s say you manufacture pens. When you sell a €1 pen to a wholesaler, you must charge 23% VAT, so the wholesaler pays €1.23. The wholesaler then sells the pen to a retailer for €2 and must also charge 23% VAT, bringing the total cost for the retailer to €2.46. The retailer then sells the pen to a consumer for €3 and must also add VAT to this price. This means the consumer pays €3.69 for the pen.

Businesses registered for VAT can claim VAT back on the goods and services they buy. So, in our example above, the retailer can claim back the €0.46 in VAT it paid to the wholesaler.

Navigating VAT Rate Complexities

The rate of VAT you should charge can be clear and obvious, but there is also a lot of complexity in Irish VAT rates. Therefore, it is best practice to always investigate the specific VAT rates that apply to your goods and services. As mentioned previously, a good place to start is the Revenue’s VAT rates database. You can also contact us at Gilroy Gannon for advice.

One area of VAT rate complexity is the fact there can be variations within the same product type. For example, children’s shoes are subject to the zero rate of VAT but only if the shoes are for children under 11. The VAT charged on shoes for teenagers is the standard rate.

Ice cream is another example. If you are a retailer, you need to charge the standard rate of VAT when a customer buys ice cream, but if you are a restaurant, you should charge the reduced rate.

It is also important to highlight that multiple rates of VAT can apply to the different products or services that your business sells. In some situations, multiple rates of VAT can even apply to a single transaction or sale.

Expert VAT Support and Advice

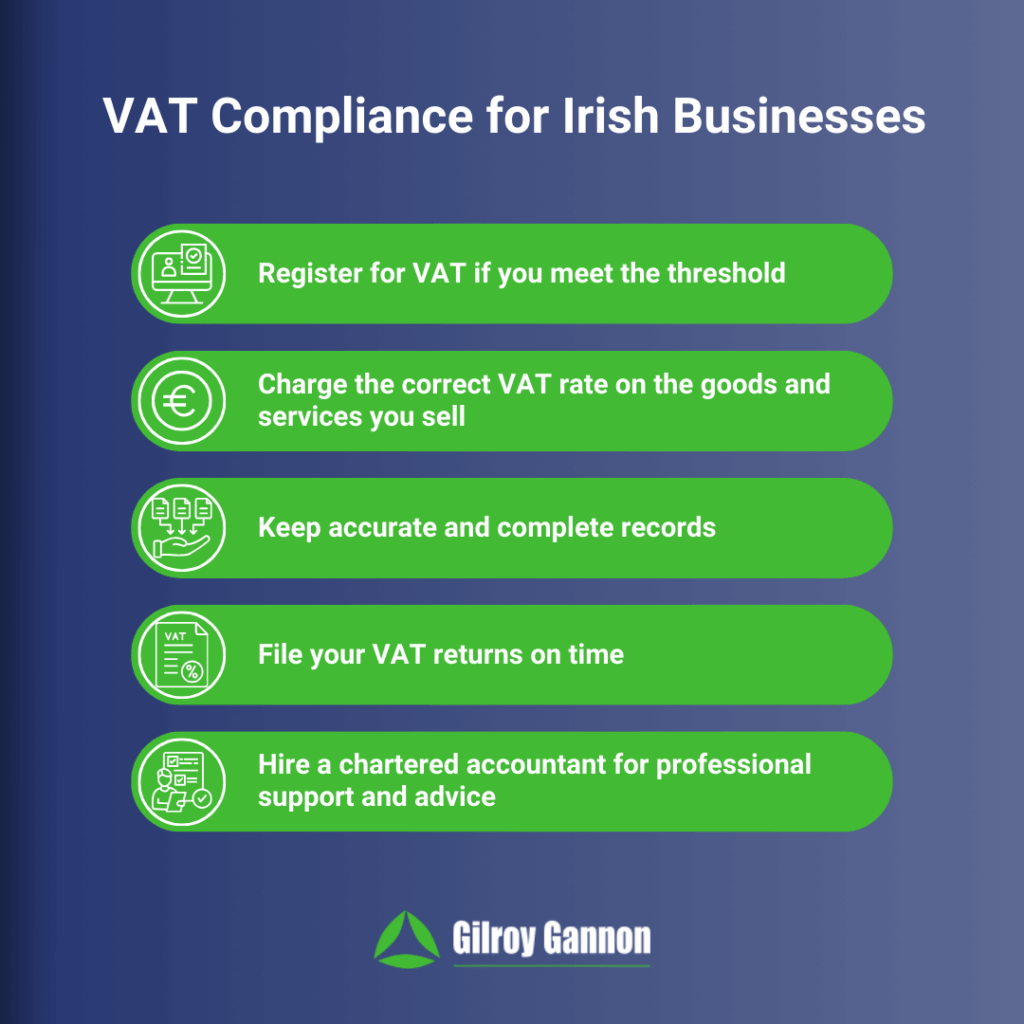

At Gilroy Gannon, we have VAT experts on our team who can provide advice as well as support on everything VAT-related, from registering for VAT to completing your VAT returns on time. Get in touch with us at Gilroy Gannon to arrange a consultation with a member of our team.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.