A Guide to Outsourcing Payroll in Your Business

Whether you have a handful of employees or a rapidly growing team, managing payroll can quickly become a challenge. Even for small businesses, the option of outsourcing payroll is one you should consider. After all, payroll outsourcing is not just for larger companies. Any business that employs staff can potentially benefit from outsourcing payroll.

In this blog, we will look at the benefits of outsourcing payroll in your business, how it works, and how to choose a payroll provider. We’ll also give you tips on how to transition from in-house payroll processing to working with a new provider.

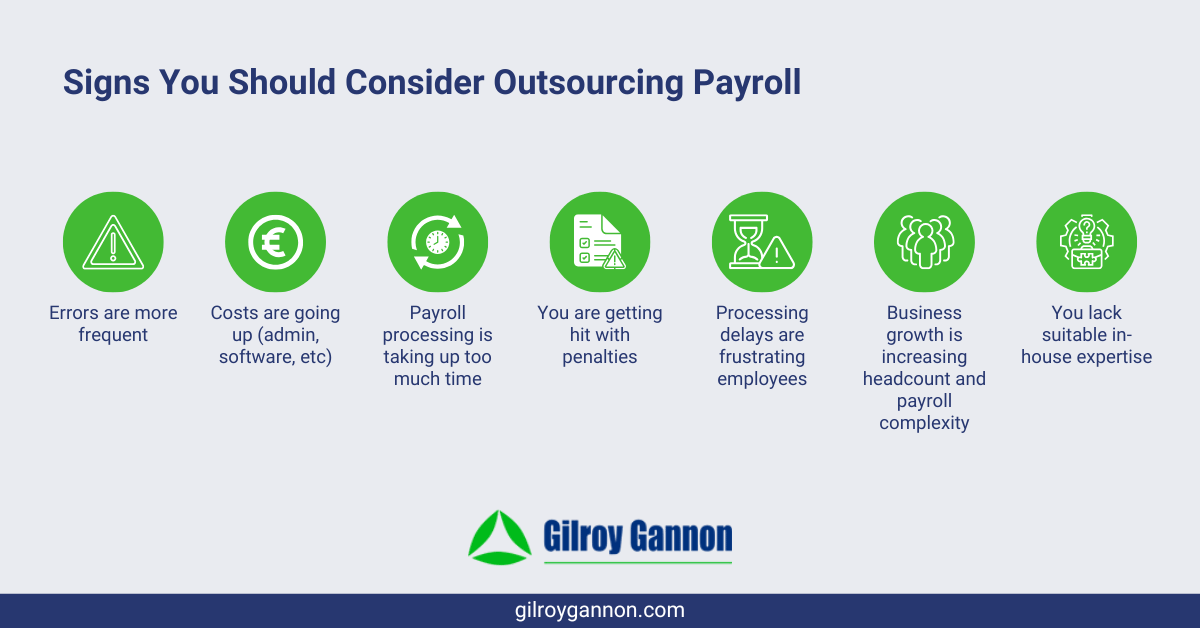

The Benefits of Outsourcing Payroll in Your Business

Focus on Your Business

Your payroll provider will handle the time-consuming and often repetitive tasks associated with processing payroll. This enables you to free up resources for more value-adding tasks.

Reduce Errors

Payroll in Ireland can be complex, so there is a reduced risk of error by partnering with an experienced payroll outsourcing provider.

Access to Expertise

Not having qualified staff in-house is a common reason for outsourcing payroll. By working with a payroll processing partner, you will get instant access to the expertise your business needs.

Legislation Knowledge

Your payroll provider will stay up to date with changes in legislation, so you don’t have to.

Compliance

Your payroll provider will ensure all elements of payroll processing are completed on time and in compliance with legislation.

Reduce Costs

Keeping payroll in-house is often a false economy, i.e., when all factors are considered, the cost of managing payroll in-house is often higher than the cost of outsourcing.

Facilitate Business Growth

Outsourcing payroll removes an administrative barrier that can slow the growth of your business, not least because growth often also means hiring new employees. Hiring new employees increases the payroll processing burden both in terms of time and cost. Furthermore, off-the-shelf payroll software packages can also quickly become more expensive as your employee headcount grows.

Service Continuity

By outsourcing payroll to an experienced provider, you will remove a potential single point of failure in your business. The single point of failure in question is the reliance on one person to process payroll, a common situation in Irish SMEs. Outsourcing to a payroll provider removes this single point of failure.

Enhanced Employee Experience

Reduced error rates in payroll processing also helps improve the employee experience, as there is less frustration from staff who have been paid incorrectly. This includes being paid late or receiving the wrong amount.

How Payroll Outsourcing Works

When you outsource payroll, the bulk of the work is transferred to your provider. However, there are still parts of the process that you will need to complete in-house. This largely comes down to data input, i.e., you will need to provide your payroll provider with the information they need each month to complete the process.

The data you will need to provide includes:

- New starters – the date joined, hours, and hourly rate or salary

- Staff who have left – the date they ceased to be employed

- Changes to existing employees – changes to hours or rates of pay

- Timesheet information – for employees who are paid hourly and/or who are paid for overtime

- Sickness – information on employees who have been off sick

- Maternity leave – the date employees go on maternity leave

- Holidays – when and for how long employees are on holiday

The days of this information being sent by paper are gone, but spreadsheets are still used by some companies. The most efficient and effective method is to use payroll software. If you use Gilroy Gannon as your payroll outsourcing partner, we can supply you with payroll software.

Aside from data input, all other elements of managing payroll are then handled by your provider. This includes:

- Calculating payments to employees

- Processing payroll on time

- Paying employees

- Sending employees their payslips

- Ensuring you remain in compliance with employment legislation

- End of year payroll processing

How to Choose a Payroll Provider

Start by assessing the needs of your business:

- What are your current challenges with payroll processing?

- What challenges do you anticipate in the future?

- What are your plans for your business? How will your plans impact employment and, by extension, payroll?

You will also need to assess the payroll provider you are considering:

- What is the reputation of the payroll provider, and how much experience do they have?

- Can the company help you with other outsourcing, accounting, or business support services?

- Can the company scale according to the needs of your business?

- Is the company based in Ireland with an expert knowledge of Irish tax, PAYE, and employment laws?

You will also need to consider the range of services to make sure the provider offers the help you need. Common services in addition to processing monthly/weekly payroll include:

- Tax calculations for PAYE, PRSI, and USC

- Payslip generation and distribution

- Year-end processing

- Revenue reporting, including ROS submissions

- Administering employee benefits

- Calculating leave, including holidays, sickness, and maternity leave

Software considerations are also important:

- What software does the company provide?

- Is it easy to use, and can you access the information you need when you need it?

- Are the reports detailed and helpful?

- Can the software be integrated with other systems used in your business?

Transitioning to Your New Payroll Provider

Given the complexity and importance of payroll processing, it is important to take steps to ensure the transition to your new payroll outsourcing provider is as smooth as possible. Tips that will help include:

- Communicate with your employees so they understand what is happening and why.

- Plan the transition according to the needs of your business. For example, consider carefully whether you should move to an outsourced provider during a particularly busy trading period for your business when your employee headcount is at a peak. It might be better to transition to the new provider in advance of this trading period.

- Allocate sufficient internal resources to manage the transition and ensure it goes as smoothly as possible.

- Consider whether to run payroll processing in parallel for the first month. This is where your new payroll processing partner does a dummy payroll run alongside your real payroll run to help identify issues before full go-live.

Outsourcing Payroll in Your Business

From lean and fast-growing start-ups through to well-established businesses, outsourcing payroll often makes sense. It is more cost-effective than many business leaders anticipate, plus it lets you channel more of your resources towards growing your business and serving your customers.

We offer expert outsourced payroll services at Gilroy Gannon. To discuss your requirements, please get in touch.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.