How to Carry Out Due Diligence on a Business

Due diligence is a detailed assessment of a company, including its finances, operations, legal compliance, management, and reputation. It’s a process that informs decision-making, but at its core, it is about risk management. In other words, the due diligence process should identify and assess all the risks associated with a business transaction to give you the information you need to make the right decisions.

Due diligence often also identifies opportunities that can be added to the decision-making mix.

In this blog, we are going to look at how to carry out due diligence on a business, with a specific focus on the due diligence process in Ireland. In doing so, we’ll highlight the main areas of a business that are investigated, assessed, and evaluated during a due diligence process.

Those areas can be categorised under three main headings:

- Financial

- Operational and commercial

- Legal

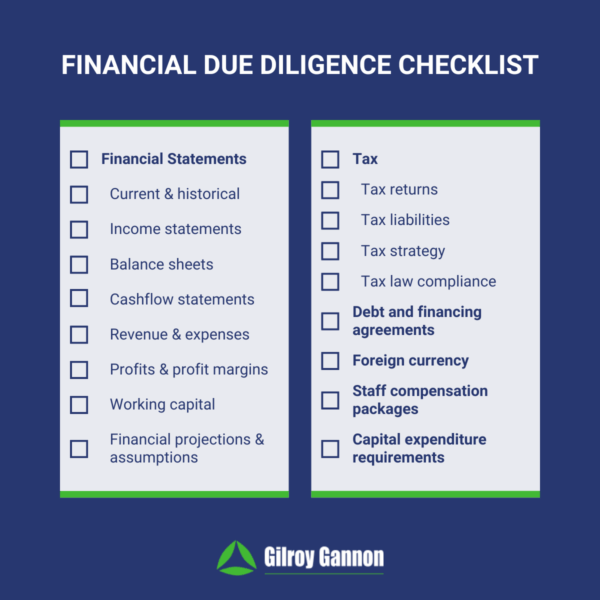

Financial Due Diligence

Financial due diligence is essential to verify known information, uncover new information, and develop a fuller understanding of the finances of the business.

Key areas that are investigated, assessed, and evaluated include:

Current and Historical Financial Statements

- Income statements

- Balance sheets

- Cash flow statements

Historical financial statements covering at least the last three to five years should be assessed. Part of this process includes evaluating financial trends, taking into account market conditions, Ireland-specific economic influences, etc.

Analysing financial statements is about getting a comprehensive understanding of the financial position of the business today and how it got here. This includes:

- Current and historic revenue and expense breakdowns.

- Profits, profit margins, and profitability drivers.

- Cash flow and working capital to assess the company’s ability to meet short-term obligations.

- The accuracy of financial projections and assumptions.

Tax

Due diligence should also involve scrutinising the company’s tax returns and tax liabilities. It’s also essential to understand the company’s tax strategy and compliance with Irish tax law.

Other

Other financial areas of the business that should be investigated, assessed, and evaluated during due diligence include:

- Debt agreements, financing arrangements, and collateral.

- Foreign currency exposures and hedging strategies.

- Compensation packages for employees and executives, including benefits.

- Any capital expenditure requirements that will be needed to sustain and enhance business growth.

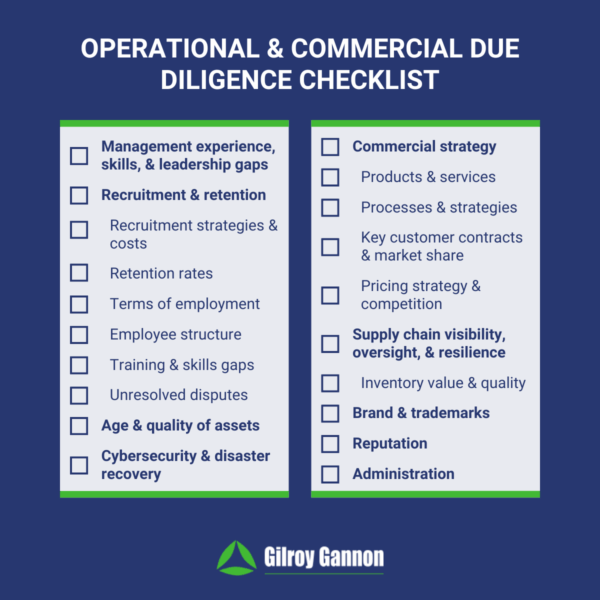

Operational and Commercial Due Diligence

Operational and commercial due diligence is about getting a comprehensive understanding of how the business is run, including the risks and opportunities.

Key areas that should be investigated, assessed, and evaluated include:

Management

Assess the skills, experience, and capabilities of the management team, including those who might depart from the business. A key part of this process is to determine if there are any gaps in leadership, especially post-transaction.

Recruitment & HR

Recruitment, retention, and HR issues are critical to the smooth running of any business. Due diligence should give you a complete understanding of the following:

- Current state of recruitment and retention, including retention rates, recruitment strategies, and recruitment costs.

- Current employee structure, roles, and responsibilities.

- Terms of employment.

- Staff training and development strategies and initiatives.

- Skills gaps.

- Unresolved employee disputes.

Commercial Strategy

It’s also important to delve deep into the company’s commercial strategy. Areas to consider include:

- The company’s current products and services, as well as product/service development roadmaps.

- Sales processes, business development strategies, and marketing.

- Key contracts, such as customer and supplier agreements.

- Concentration of revenue to understand the company’s reliance on key customers and the potential impact if key customers are lost.

- Market share, pricing strategies, competitors, and long-term commercial viability.

Supply Chain

Supply chain disruption has been a critical focus area for many businesses over recent years. Key areas to explore during a due diligence process include:

- Reliance on key suppliers and the state of contingency plans.

- Supply chain visibility, transparency, and oversight.

- The overall robustness and resilience of the supply chain.

- Inventory, including its quantity, quality, and realistic commercial value.

Intangible Assets

The business you are conducting due diligence on is also likely to have intangible assets that should be considered and assessed as part of the process. These include:

- The company’s brand, trademarks, and goodwill.

- The company’s market reputation, including taking into account the views of customers, suppliers, employees, and other stakeholders.

Operations

Other operational areas that should be evaluated as part of due diligence include:

- The age, efficiency, and condition of assets, including vehicles, equipment, and IT systems.

- Cybersecurity and disaster recovery processes and strategies.

- Administration structures.

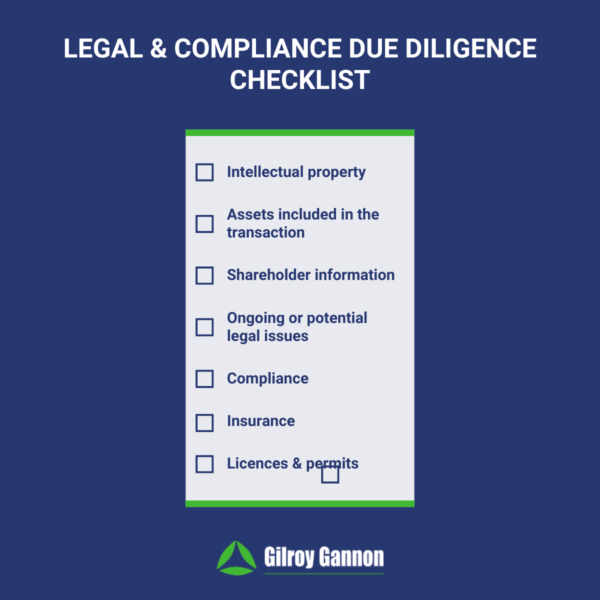

Legal and Compliance Due Diligence

Legal and compliance issues can have a significant impact on the profitability and viability of a business, so it’s important they are fully understood before any transaction takes place. Important areas to consider include:

- Intellectual property, especially where the IP is valuable.

- The assets being sold to understand if you are purchasing the entire company, specific assets, or, for example, just the goodwill and customer lists.

- Shareholder information, including ownership percentages.

- Any ongoing or potential litigation, claims, or legal disputes.

- The level of compliance with all relevant laws and regulations.

- Insurance policies and claims history.

- Compliance with labour and employment law in Ireland and any other jurisdictions where staff are employed.

- The state of any necessary licenses and permits.

- Environmental compliance and any past investigations.

Expert Due Diligence Support

This blog provides an overview of the main areas that are investigated and assessed as part of a due diligence process. The process itself is complex and very detailed, but expert support is available.

At Gilroy Gannon, we have experience providing due diligence services in a wide range of situations, including all types of business transactions. To arrange a consultation to discuss your requirements, please get in touch.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.