Mitigating the 2026 Minimum Wage Increase: Strategies for Improving Operational Efficiency

From 1 January 2026, the national minimum wage in Ireland increased to €14.15 per hour. The reasons for regularly increasing the minimum wage are well-rehearsed, but for many businesses, complying with the new rates can present challenges.

This especially applies to businesses with large numbers of employees paid at or close to the national minimum wage. Small and medium-sized businesses can also have less wiggle room in their finances to easily absorb mandated wage increases.

In this blog, we look at strategies your business can explore to mitigate the impact of the 2026 national minimum wage increase.

Ensure Compliance

Ensuring compliance is a top priority, and that starts with understanding how the national minimum wage applies to your employees. The table below shows the minimum wage rates that came into effect in Ireland at the start of 2026.

| Age of Employee | National Minimum Wage (effective 1 January 2026) |

|---|---|

| Over 20 | €14.15 per hour |

| 19 years old | €12.74 per hour |

| 18 years old | €11.32 per hour |

| Under 18 | €9.91 per hour |

One of the first steps you should take if you haven’t already done so is to review employee contracts and payroll. Make sure to include any impact on overtime rates, holiday pay, and PRSI contributions.

It’s also important to check salaried employees to ensure their monthly or weekly salary equates to the minimum hourly rate. The Workplace Relations Commission’s website includes information on what you can and can’t include when calculating an employee’s wage to ensure it meets the threshold.

And it’s important to note that you have to keep three years’ worth of records that show you have paid your employees the national minimum wage.

Workforce Planning and Optimisation

Workforce planning and optimisation can help to mitigate the impact of national minimum wage increases. Areas to look at include:

- Recruitment and retention – are you doing enough to maximise retention to reduce recruitment costs? This doesn’t just mean increasing wages, but also looking at things that employees value, such as a positive work culture, training opportunities, or flexible working.

- Staffing – are you over-staffing shifts or using higher-paid employees for low-value tasks?

- Rates – can you make operational changes to reduce higher rates of pay, such as weekday shifts rather than weekend shifts?

It’s also important to remember that minimum wage increases don’t just impact your lowest-paid employees. This is because increases in the wages of your lowest-paid employees narrow the gap to the next level. This might mean you also have to review what you pay managers and supervisors, for example.

Financial Planning

Good financial planning is essential to mitigate the impact of national minimum wage increases. This fact will only become more critical if Ireland transitions to a national living wage rather than a minimum wage.

So, you should budget and plan ahead. It can also be helpful to identify ways to optimise labour costs. For example, could adjusting staff hours save you money? There might also be government or local authority grants you can apply for that can not only help with budgeting but also make improvements in other parts of your business.

Increase Prices to Customers

Passing on costs to your customers is an effective way to mitigate the impact of national minimum wage increases. However, you have to approach price increases the right way to reduce the risk of losing customers.

How you increase prices varies from business to business and industry to industry. In retail, for example, it involves changing the price of your products on the shelves or rails. For B2B businesses, on the other hand, price increases will need to be properly communicated to customers in advance.

Some strategies that you can use when increasing prices include:

- Implement regular but small increases in prices (less than about 3%) to make it easier for your customers to absorb.

- Highlight added value, such as product improvements or service enhancements.

- Offer tiered or premium pricing options. Price bundling, where you package products or services together, can also be effective.

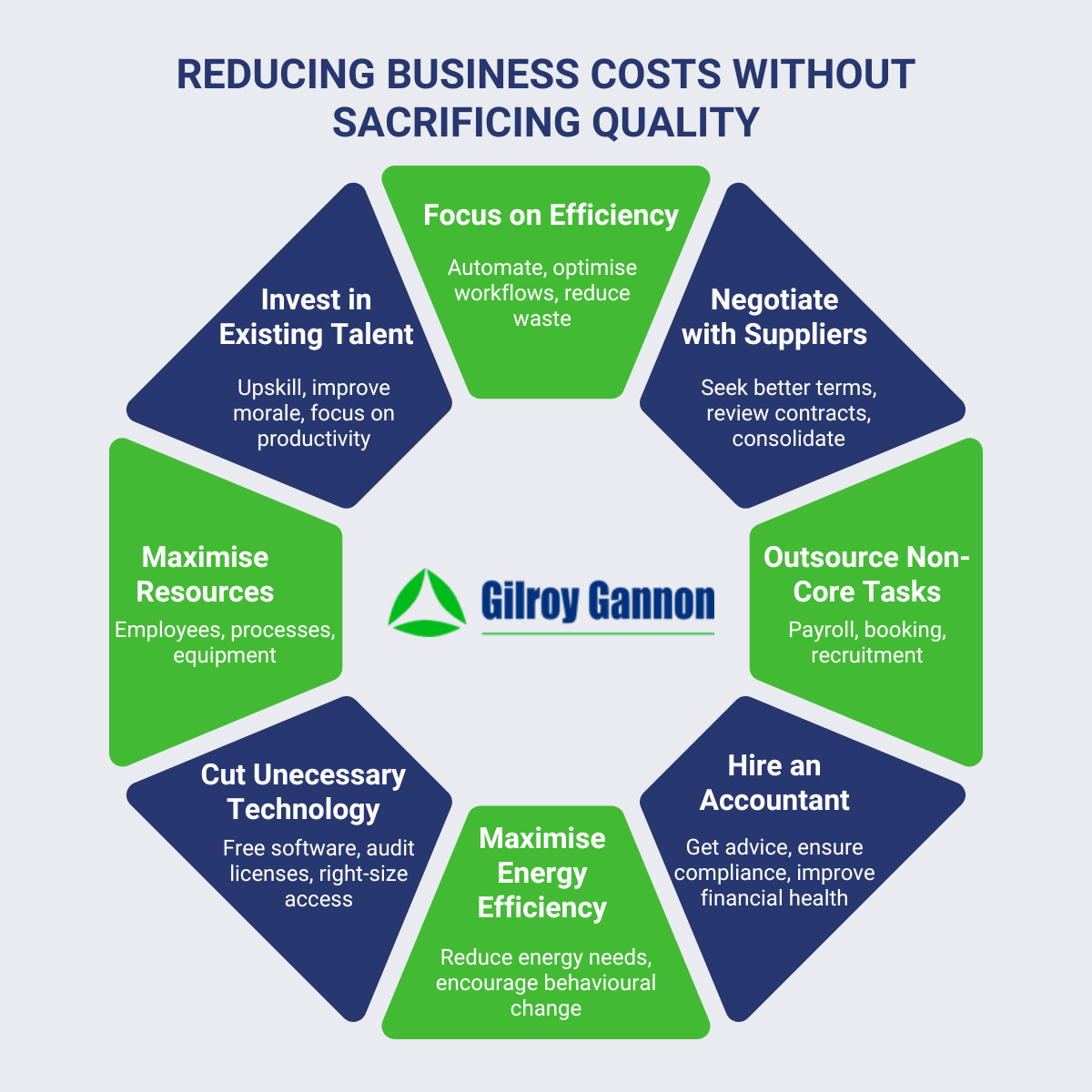

Reduce Costs

Exploring ways to reduce costs can also mitigate the impact of national minimum wage increases. The best approach is to identify ways to reduce costs that won’t impact the quality and level of service you offer to customers. An example is reviewing your suppliers and the vendors you work with to see if better options or terms are available.

Optimise Operations

You should also explore ways to improve efficiency and reduce waste in your business. Two examples are automating manual processes, such as invoicing, and outsourcing tasks such as payroll.

It’s also worth reviewing sales in your business. For example, what can you do to ensure customers pay you on time? Are you maximising the relationships you have with existing customers? Are there growth opportunities you should explore?

Mitigating the Impact of National Minimum Wage Increases

Making sure your business can continue to operate profitably after an increase in the national minimum wage typically requires a multi-faceted approach. It should be viewed as an opportunity to optimise payroll, improve staff retention, and reduce inefficiencies.

We can help at Gilroy Gannon in areas such as financial planning, business advisory, and outsourcing. Get in touch to arrange a consultation with a member of our team.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.