Business Restructuring – Essential Steps

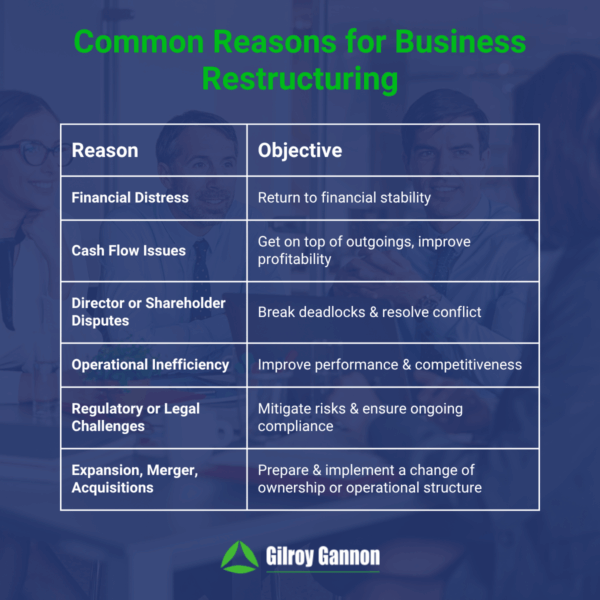

Business restructuring is a necessary and/or preferred course of action in a range of situations. This includes overcoming financial challenges, mitigating risks, and dealing with operational issues. Separating assets or business divisions is another reason, as is making the structure of your business more competitive in the market, suitable for succession planning, or attractive as an acquisition target.

Business restructuring can be a difficult time for businesses, owners, directors, shareholders, and employees, but it can have a positive outcome. Positive outcomes are not guaranteed, however, so it’s important to follow business restructuring best practices.

In this blog, we will outline the essential steps involved in a successful business restructuring process.

Essential Steps to Restructure a Business

Conduct a Business Review

The starting point is to conduct a thorough review of your business. This includes:

- Evaluating the current position of the business financially, commercially, operationally, and competitively.

- Identifying the drivers behind the need to restructure. What are the root causes of financial difficulties, for example?

- Evaluating the financial and operational performance. This involves going beyond an assessment of your current position to analyse how far above or below expectations the business is performing financially and/or operationally.

- Identifying current and future risks, including compliance, legal, and governance risks.

- Identifying key areas for improvement.

- Outlining the current ownership position of the business, including any disputes between shareholders and/or directors that could impact the restructuring.

Define Objectives

Define clearly what you want to achieve with the business restructuring process. Examples include saving the business if it is in financial distress or preparing the business for a potential acquisition.

Conduct a Viability Assessment

By this stage of the process, you will have a clear understanding of your business as it is today and the objectives you want to achieve by restructuring. You should then assess the viability of the business in its restructured form:

- Will the business be financially and operationally viable once it is restructured?

- What will be needed to support the business and its growth during the process and post-restructuring?

Develop a Restructuring Plan

You should create a detailed restructuring plan. Best practices include:

- Get input from key staff and stakeholders.

- Create financial restructuring plans, such as cost reduction plans, refinancing strategies, and steps to improve working capital

- Clearly define changes to the structure of the business and the steps that need to be taken to get there.

- Consider regulatory and legal requirements and outline any steps that need to be taken. For example, complying with employment law and company policies if the restructure involves staff redundancies.

- Decide on a timeline for the restructure with well-defined milestones.

- Establish contingency plans if your preferred restructuring approach doesn’t work out.

Implement the Restructuring Plan

The next stage is to implement your restructuring plan. Key parts of this process include:

- Negotiate with creditors, investors, and banks.

- Change the legal and/or operational structure of the company.

- Complete any relevant transactions, such as selling shares or assets.

- Update documentation, including contracts and policies.

- Restructure business operations, including workforce changes.

- Communicate with all stakeholders, including employees, directors/shareholders, customers, suppliers, creditors, lenders, etc.

- Provide appropriate support for employees, such as training, information sessions, and opportunities to provide feedback.

Monitor, Review, and Refine

Planning is important, but there is no way to guarantee that everything will go as you intend it to. Therefore, monitoring and reviewing progress is important, as is making changes and refinements when required. Best practices include:

- Monitor progress during and post-restructuring.

- Be prepared to make adjustments if necessary.

- Assess the business against your business restructuring objectives.

- Identify areas where improvements can be made.

Best Practices When Restructuring a Business in Ireland

- Focus on the long-term.

- Don’t rush, but don’t delay either. Rushing leads to mistakes, while delaying can reduce the restructuring options you have available.

- Get professional advice and support as early in the process as possible.

- Regularly communicate with stakeholders.

- Don’t underestimate the potential impact of change on employees.

- Document everything as you go.

Business Restructuring Support from Gilroy Gannon

Whatever your reasons for restructuring your business, we can help at Gilroy Gannon. We have extensive experience, including dealing with complex financial and operational problems. Our team will provide you with expert advice and practical support to get your business on course for growth and success. Get in touch with us today to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.