Pension Auto-Enrolment 2026: An Employer’s Guide to the 3:3:1 Contribution Model

The government’s auto-enrolment pension saving scheme is up and running. Known as MyFutureFund and managed by the National Automatic Enrolment Retirement Savings Authority (NAERSA), the scheme aims to increase pension coverage in Ireland.

In this blog, we will recap the main points of the scheme, including the 3:3:1 contribution model.

Auto-Enrolment Eligibility

The criteria for employees to be auto-enrolled in MyFutureFund are as follows:

- Aged between 23 and 60

- Earning over €20,000 a year

- Not currently paying into a qualifying pension via payroll, i.e., an occupational pension

Employees who do not meet the above criteria but are aged between 18 and 66 can choose to opt in.

Employers are legally required to fulfil their obligations under the scheme, including paying contributions and deducting contributions from the salaries of auto-enrolled employees.

The 3:3:1 Contribution Model

Contribution rates are based on a 3:3:1 contribution model. So, for every €3 an employee is required to contribute, their employer must also contribute €3, while the government will pay €1.

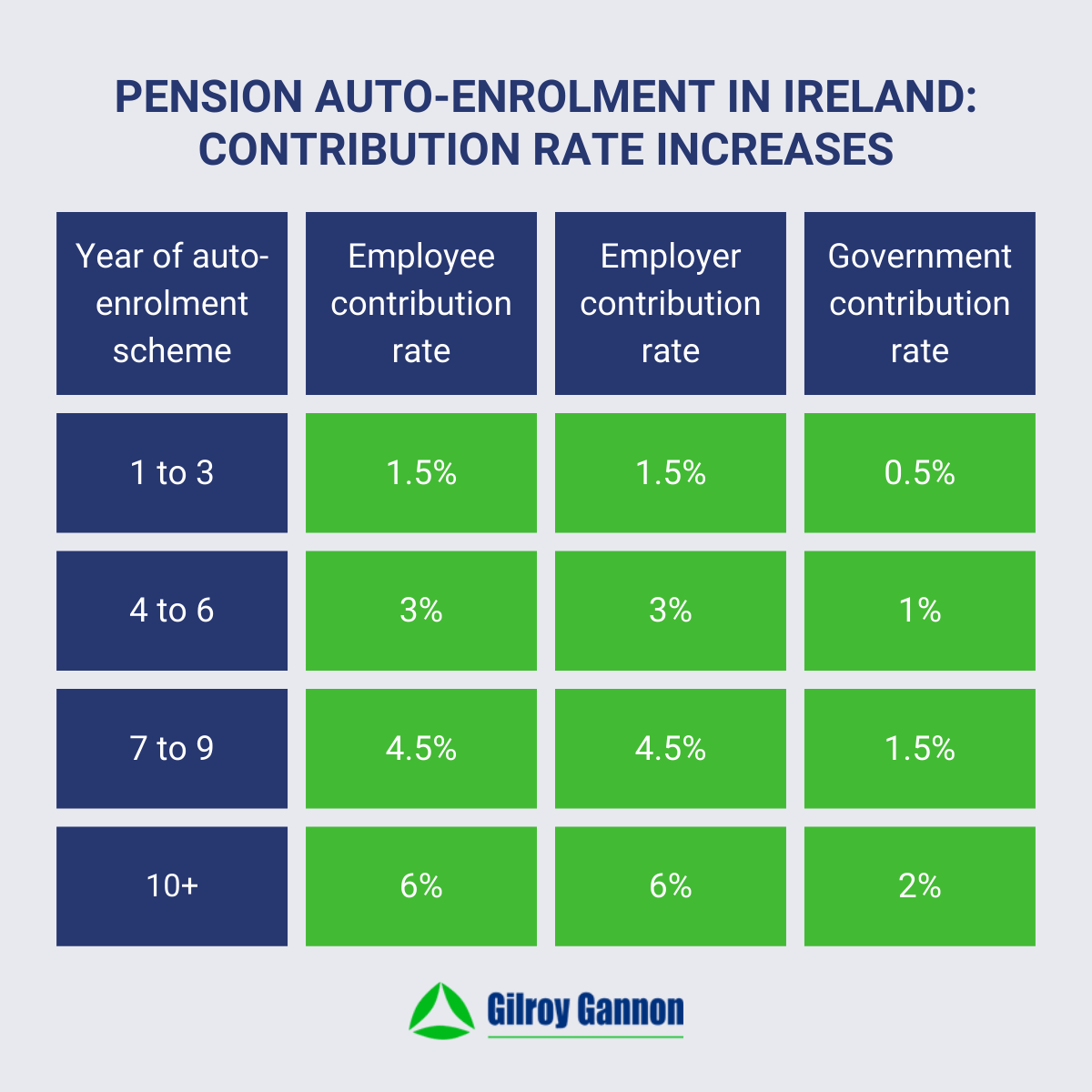

The percentage contribution starts at 1.5% for employees, 1.5% for employers, and 0.5% for the government. These rates increase every three years, topping out at 6%, 6%, and 2% after 10 years, i.e., 6% for employees, 6% for employers, and 2% for the government.

How Contribution Rates Will Increase

As mentioned above, in the first three years of auto-enrolment, employees will pay 1.5% of their salary. Their employer will also pay 1.5%, and the government will pay 0.5%.

In years four to six of being auto-enrolled in MyFutureFund, the employee contribution rate increases to 3% of their salary. The employer’s contribution is also 3%, and the government’s contribution increases to 1%.

In years seven to nine of being auto-enrolled in the pension savings scheme, employees will pay 4.5% of their salary. Employers will pay the same percentage, and the government will pay 1.5%.

From year 10 on, the contribution rates are 6% for employees, 6% for employers, and 2% for the government.

Pension Auto-Enrolment Contribution Rate Example

This example shows the contributions that will be paid into the MyFutureFund scheme for an employee earning €40,000 a year.

| Year of auto-enrolment scheme | Annual employee contribution | Annual employer contribution | Annual government contribution | Total annual contributions |

|---|---|---|---|---|

| 1-3 | €600 (1.5%) | €600 (1.5%) | €200 (0.5%) | €1,400 |

| 4-6 | €1,200 (3%) | €1,200 (3%) | €400 (1%) | €2,800 |

| 7-9 | €1,800 (4.5%) | €1,800 (4.5%) | €600 (1.5%) | €4,200 |

| 10+ | €2,400 (6%) | €2,400 (6%) | €800 (2%) | €5,600 |

Other Points to Note

There are some other important points that employers should be aware of when administering the auto-enrolment scheme on behalf of employees:

- Contribution cap – contributions are capped at an annual salary of €80,000. This means contributions will stop once an employee earns over €80,000 in a calendar year. Contributions will start again at the beginning of the next calendar year.

- Income tax relief – employee contributions do not qualify for income tax relief. This is a key difference between the auto-enrolment scheme and an occupational pension (occupational pension schemes typically do qualify for income tax relief).

- Opt-out – employees can choose to opt out of the pension saving scheme after six months. Employees have a window of two months to choose this option. If they do, they will get a refund of the contributions they have made. When the contribution rates go up every three years of auto-enrolment, employees will get another opportunity to opt out six months after the rates go up.

- Re-enrolment – employees who choose to opt out will be automatically re-enrolled after two years, provided they remain eligible. They can then choose to opt out again after six months.

- Pausing contributions – employees cannot opt out after eight months, but they can choose to pause contributions.

Expert Advice and Support

The auto-enrolment pension savings scheme is new for Ireland, and it is also new for employers. In some situations, it can be complex, and there is an additional administrative burden.

We can provide support to ensure you meet your obligations, as well as advice. Contact us at Gilroy Gannon to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.