An Essential Guide to Succession Planning in Ireland

If the hit television show Succession is anything to go by, succession planning is all about extraordinary levels of excess and vicious interpersonal relationships. In reality, succession planning is much more normal, nuanced, and varied, covering a wide range of situations.

Succession planning is important for companies with directors and boards, family-owned businesses, farms, and many other types of organisations that don’t fit neatly into any of these categories. In very general terms, it is a process aimed at ensuring business continuity and a smooth transition when those currently running the business are no longer around. This could be a result of retirement, death, illness, or a range of other circumstances where the leadership and/or ownership of the business goes through a period of substantial change.

Our essential guide to succession planning in Ireland will give an overview of why it is important, key issues to consider, and the main steps you should take.

There will be a theme running throughout the guide: the importance of getting tailored, expert advice. Every business, business owner, and leadership team is different, so the main takeaway from this blog is to get third-party succession planning support.

Why Succession Planning is Important

The main reasons effective succession planning is important include:

- Ensures business continuity when there is a change of leadership/ownership.

- Ensures the transition to the new owners or leaders is as smooth as possible.

- Helps retain talent and knowledge within the business following the period of change.

- Helps to protect your legacy.

- Helps ensure a secure financial future for your family.

- Maintains client and stakeholder confidence.

Reduces costs, including costs to the business as well as, where applicable, costs to your loved ones.

Legal and Regulatory Considerations

In Ireland, there are a number of legal and regulatory issues that could be applicable to your situation, as well as asset and wealth management considerations.

The main tax considerations, for example, include capital acquisition tax (CAT), capital gains tax (CGT), and inheritance tax. Other tax, asset, and wealth management considerations include:

- Family partnerships

- Retirement relief

- Stamp duty

- Retirement planning

- Section 72 insurance policies

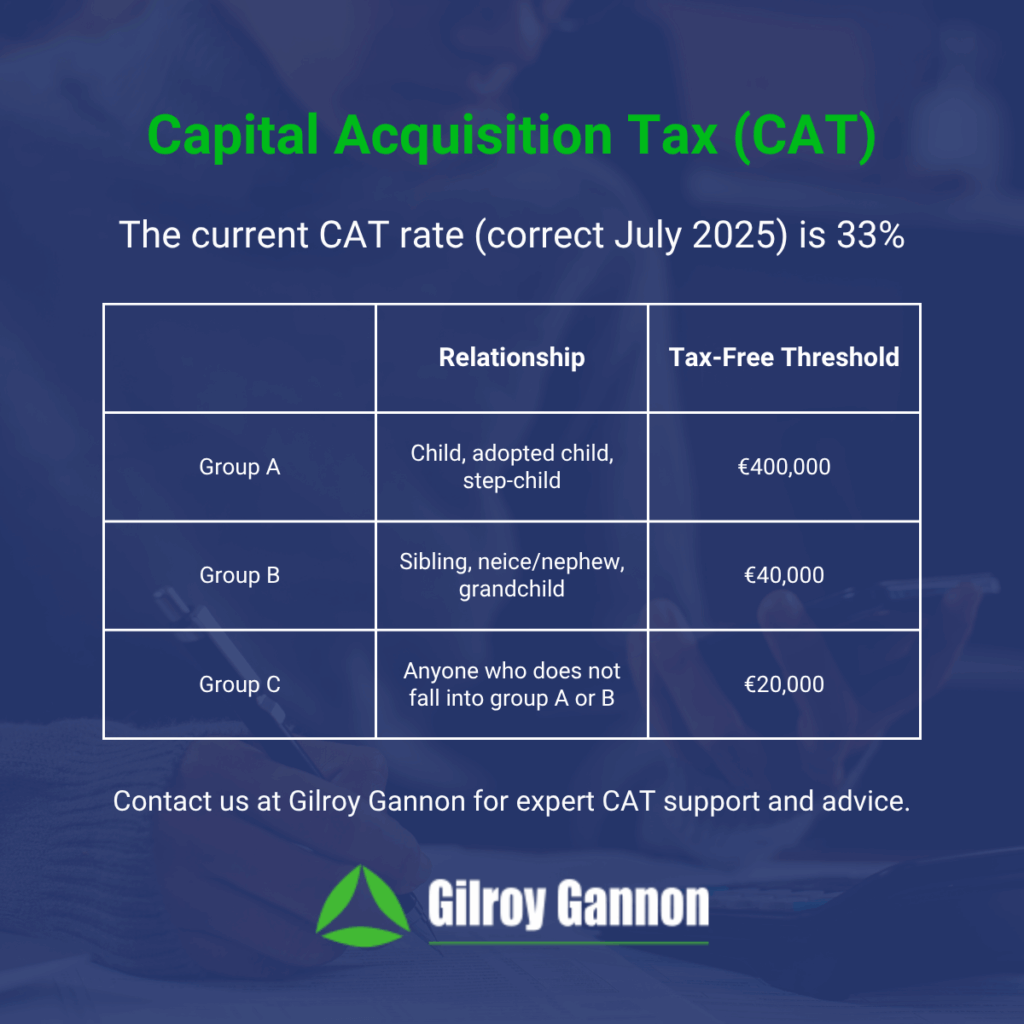

This is a very complex area of Irish law and tax regulations. We’ll use one of the above considerations as a broad example – CAT. In Irish tax law, there are threshold levels where individuals can receive a gift or inheritance without incurring CAT, i.e., gifts or inheritance up to the threshold are CAT-free, while those over the threshold incur CAT.

However, there are different thresholds depending on your relationship to the individual. There is also a small gift exemption to potentially factor in, and rules that allow CGT liability to be used as credit against the amount of CAT that is due.

In other words, CAT is a complex calculation, and it’s only one area of potential complexity. Getting expert advice is essential.

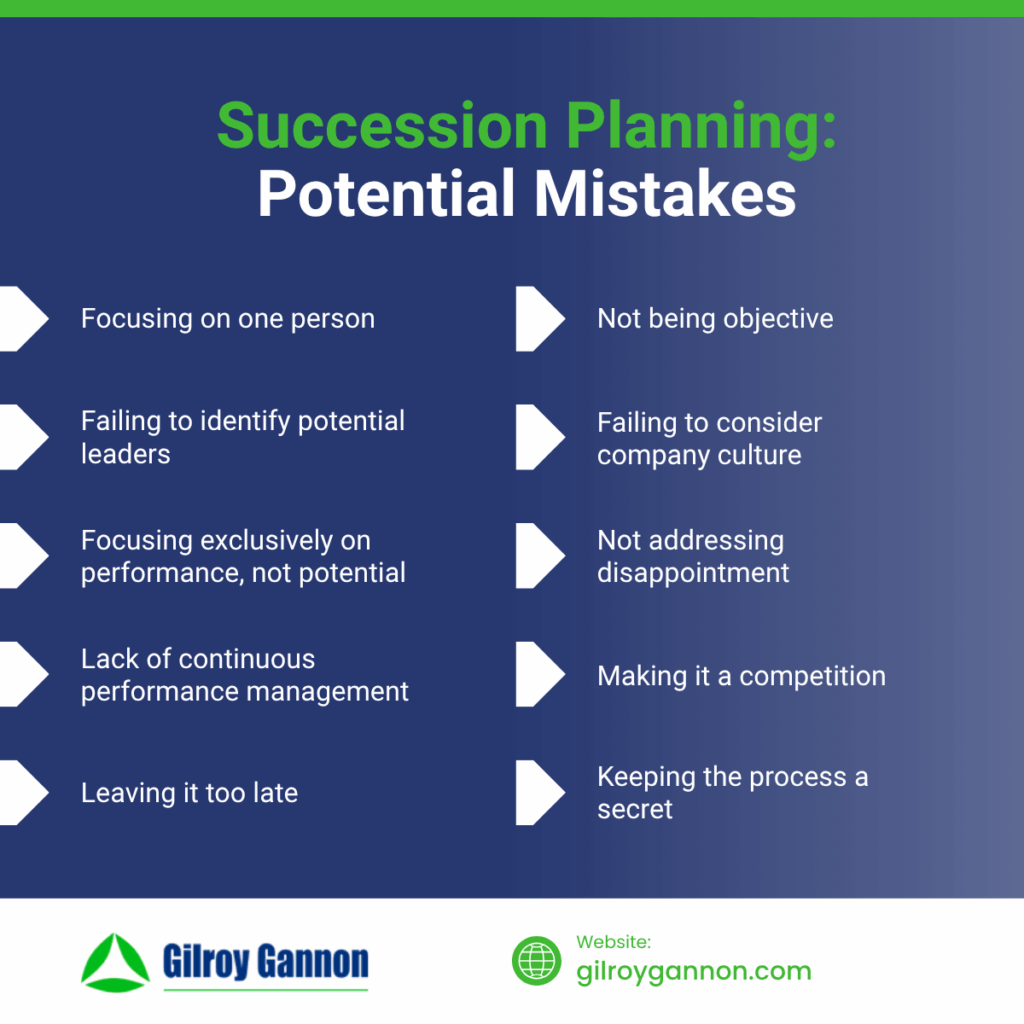

Tips for Effective Succession Planning in Ireland

In addition to getting expert advice, the following tips will help with the succession planning process.

Start Early

Thinking about what will happen to your business after you are no longer involved can feel awkward and a bit of a distraction, but it is important to start the process as soon as practically possible. There are a lot of elements to get in place, so starting early is beneficial.

Identify Successors

Your successor or successors can come from three main groups of people:

- Family members, whether currently in the business or not

- Non-family members currently involved in the business

- Non-family members from outside the business

Identifying your successor/s is an essential part of the succession planning process.

Discuss Your Plans

It is important to discuss your plans with the people who will take over the business. It might also be beneficial to have honest and open conversations with other relevant individuals, especially family members.

Involve Senior Leadership

Involving members of your senior leadership team will help the process, as they will bring fresh opinions and perspectives.

Develop Your Successor/s

The individual or individuals you have chosen as your successor may not yet have the skills or expertise needed to successfully run the business once you are no longer involved. Mentors can support your successors once they take over, but you should also create opportunities for skills development.

Assess Your Workforce

The change in management structure might create skills gaps in other parts of your business. Identifying these potential gaps and putting in place mitigation measures is important.

Create a Succession Timeline

Where possible, create a succession timeline to give everyone involved clarity over the change management process.

Develop a Business Structure

Drafting a new business structure will help prevent skills or leadership vacuums from developing.

Communicate Internally and Externally

Good communication is crucial to effective succession planning, both internally with staff members and other key stakeholders, as well as externally with customers, suppliers, and others.

Create an Emergency Succession Plan

Having a structured succession plan is important, but it is also beneficial to plan for the unexpected, i.e., where your departure from the business occurs sooner than planned. An emergency succession plan will not be as effective, but it will give the business and your successors the best chance of working through a potentially difficult period.

Supporting Your Succession Plan

At Gilroy Gannon, we have extensive succession planning expertise and a track record of working with a vast range of businesses and business owners. That expertise extends to tax, regulatory issues, asset management, wealth management, business planning, business structures, and change management.

To speak to one of our advisors about succession planning, please get in touch with us at Gilroy Gannon today.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.