An Overview of VAT Registration in Ireland

VAT (Value-Added Tax) is an indirect tax applied to goods and services in many countries, including Ireland. It is added at each stage of the supply chain and is collected by businesses on behalf of the government. Most businesses in Ireland will need to be registered for VAT.

Registering for VAT brings both obligations and benefits. In this blog, we will look at VAT thresholds, including what they are, the current values, and how they are calculated. We’ll also look at how to register for VAT and your obligations once registered.

Before getting started, it is important to point out that this blog is a general overview. It is essential to always seek specific advice on VAT registration from a chartered accountant based on your circumstances.

VAT Thresholds

Businesses registered and operating in Ireland must register for VAT when their turnover exceeds, or will probably exceed, the relevant VAT threshold within any continuous 12-month period. Businesses must register for VAT within 30 days of exceeding the relevant threshold.

There are some exceptions to this rule, such as businesses involved in cross-border TBE (telecommunication, broadcasting, and electronic) services. More information is on the Revenue’s website. You should also get advice from a Chartered Accountant who can give you guidance based on your specific circumstances.

Current VAT Thresholds in Ireland

The main VAT thresholds for businesses registered in Ireland include:

- €42,500 – if you supply services only.

- €42,500 – if you supply goods that incur VAT when sold but that you manufacture from zero-rated materials.

- €85,000 – if you supply goods and services where 90 percent or more of your turnover comes from the supply of goods.

- €85,000 – if you supply goods.

The VAT thresholds listed above will cover the majority of businesses. There are a couple of other VAT thresholds that apply in very specific circumstances, including if your business buys more than €41,000 worth of goods over a 12-month period from businesses in other EU member states. More information is on the Revenue’s website, or you can contact a member of our team for expert advice.

How VAT Thresholds Are Calculated

When calculating your turnover in relation to VAT thresholds, you should take into account the VAT you paid on any stock you purchased for resale. The value of that VAT can be subtracted from your total turnover to give you a figure you can use against the VAT thresholds.

Example VAT Threshold Calculation

A business owner running an online store based in Ireland has a 12-month turnover of €95,000. She incurred €11,960 in VAT to purchase goods that she went on to sell to her customers in Ireland. The business owner can subtract €11,960 from her total turnover, giving an adjusted turnover of €83,040. As the adjusted turnover is below the €85,000 VAT threshold, she is not obliged to register for VAT.

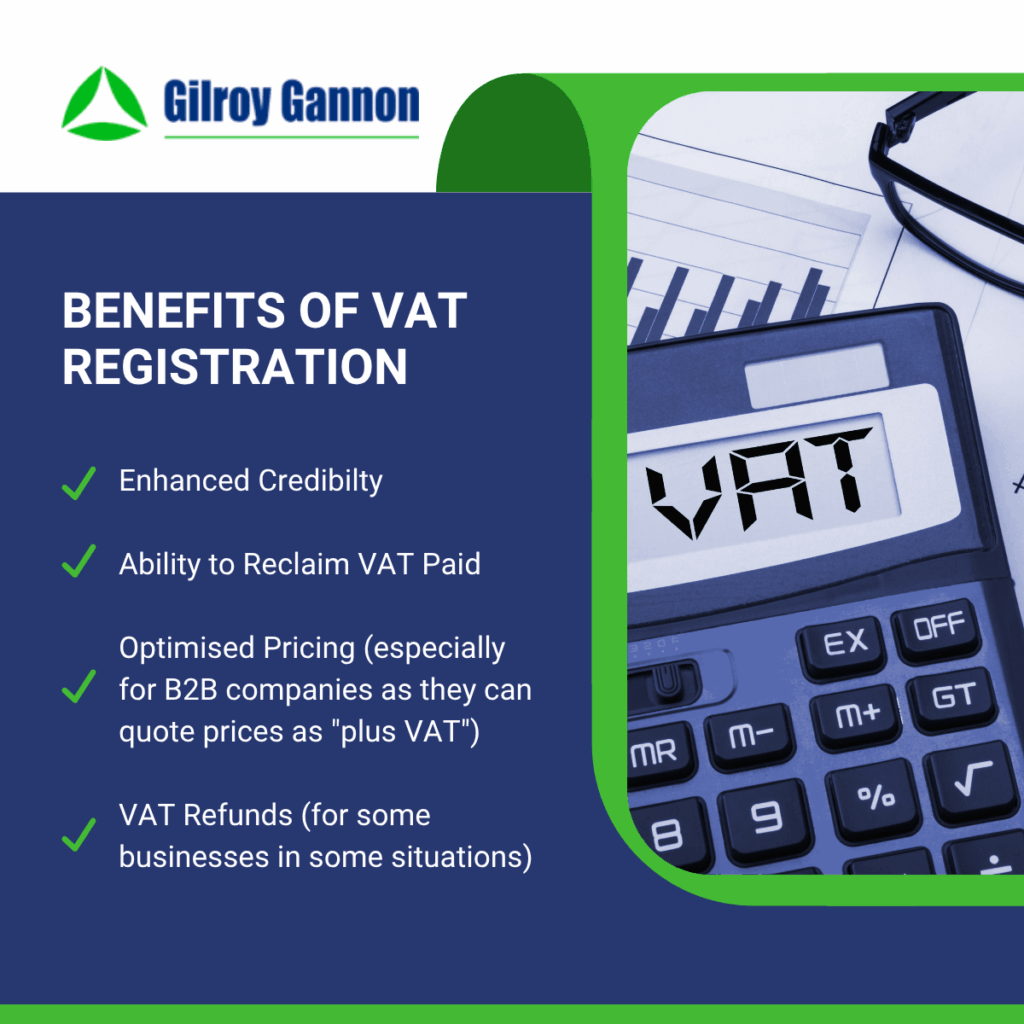

Electing to Register for VAT

Businesses that have a turnover lower than the VAT thresholds are not required to register for VAT, although they can elect to do so, i.e., they can register for VAT voluntarily if they see benefits of doing so.

The same applies to farmers and sea fishers – they are not required to register for VAT but can elect to do so.

How to Register for VAT in Ireland

There is a two-tier VAT registration system in Ireland:

- One tier is for businesses that trade solely in Ireland.

- The second tier is for businesses that trade in other EU countries.

Businesses registered in Ireland should use the Revenue Online Service (ROS) to register for VAT. You will need to provide proof of a physical presence in Ireland as well as economic activity in Ireland. Office lease agreements, invoices, and contracts are examples of the types of documents you can supply as proof.

Businesses registered outside Ireland that want to obtain an Irish VAT number need to complete paper forms before submitting them to the Office of the Revenue Commissioners.

In both situations, there is one form for limited companies and another for other types of businesses – sole traders, individuals, partnerships, and trusts.

Date of Registration

Generally, you will be considered registered for VAT from the date that you put on your registration form. In some situations, registration can be backdated, but this must be agreed by the Revenue.

Your Obligations Once VAT Registered

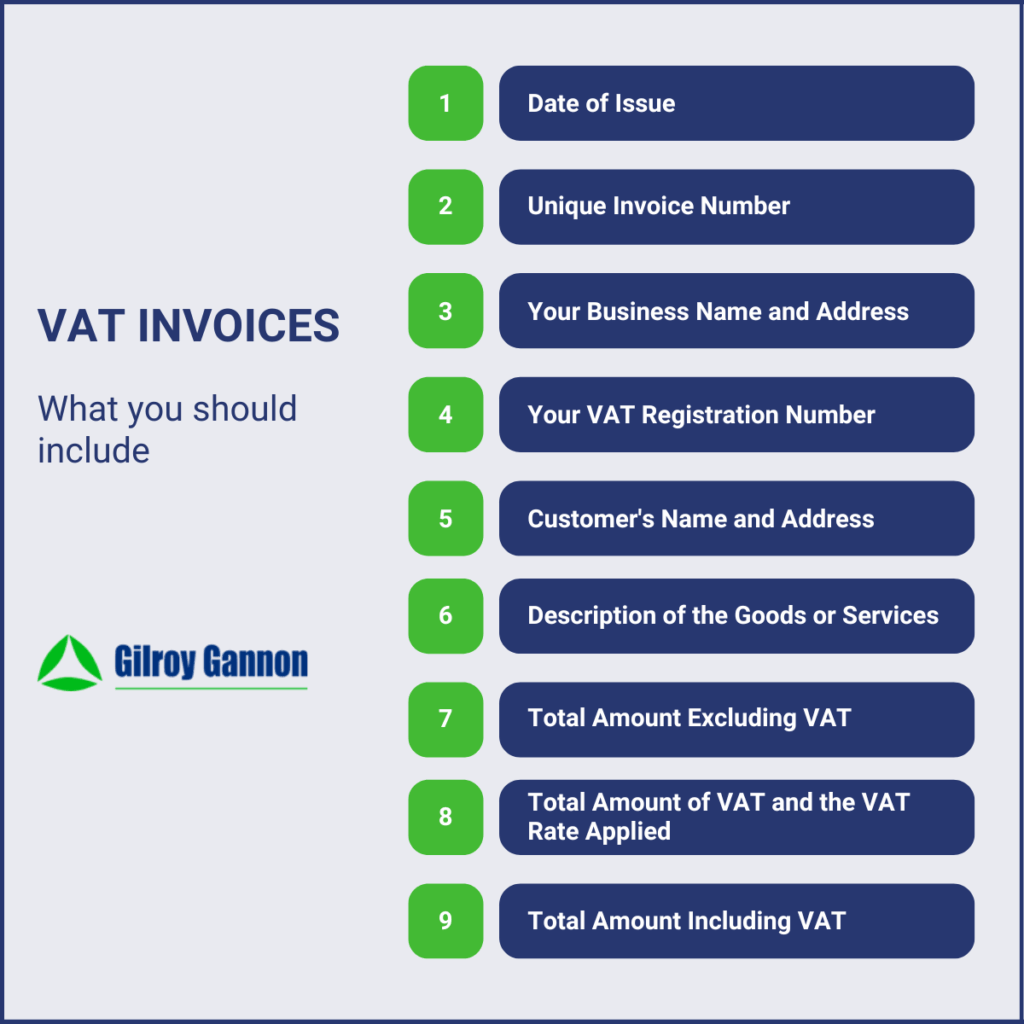

Once VAT registered, your obligations include:

- Charge your customers the correct VAT rate

- File VAT returns on time

- Pay any VAT that is due on time

- Keep accurate records of VAT-related transactions

If you collect more VAT from customers than you pay to suppliers, you must pay the difference. If you pay more VAT to suppliers than you collect from customers, you will get a refund.

Registering for VAT in Ireland

Registering for VAT in Ireland depends on a range of factors, including your turnover, whether you sell goods or services, where your customers are located, and where your business has been established.

We have outlined the main points in this blog, including VAT thresholds and how they are calculated, voluntarily registering for VAT, and the process of obtaining a VAT number.

Our team at Gilroy Gannon has extensive experience supporting businesses as they register for VAT in addition to ensuring ongoing VAT compliance. Contact us today to discuss your requirements.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.