Best Practices When Getting Tax Advice for Your Business

For business leaders and company owners, making the right tax decisions isn’t just about compliance. Compliance is very important, but making good tax decisions can also unlock opportunities for growth, minimise liabilities, and safeguard the future. Whether you’re a start-up founder or running an established company, getting good tax advice is an essential part of an optimised business strategy.

In this blog, we look at the best practices for getting tax advice for your business, starting with engaging a Chartered Accountant.

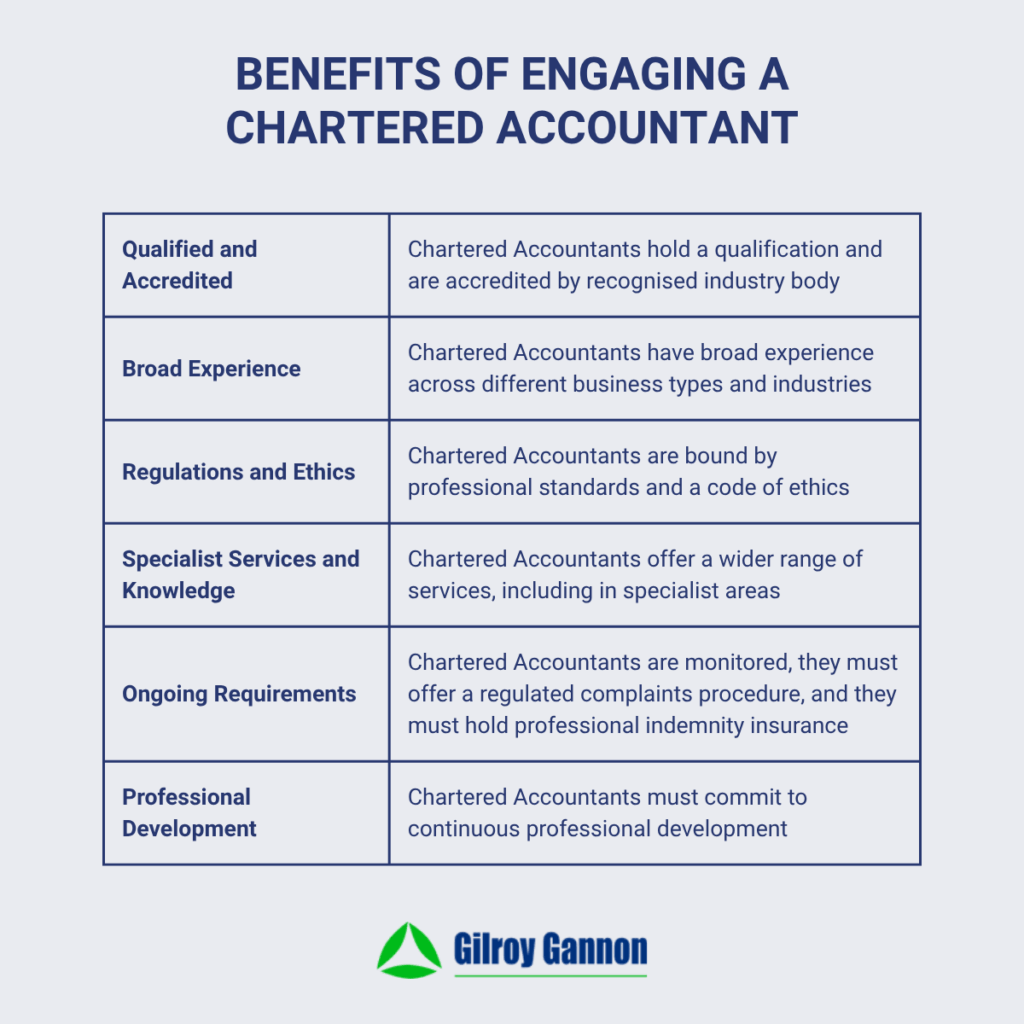

Engage a Chartered Accountant

You will get the best tax advice tailored for the specific circumstances of your business by engaging a Chartered Accountant. A Chartered Accountant will have expertise in Irish tax law in addition to extensive experience working with businesses of different types, optimising their tax position. Your business will benefit from this expertise and experience.

It’s important to remember that tax law is complex, with the level of complexity increasing if you find yourself in an audit situation or another type of dispute with the Revenue. A Chartered Accountant will help you navigate the complexities of Irish tax law to ensure you are both fully compliant and tax optimised.

Regular Engagement with Your Accountant

The needs of your business are constantly evolving, the economic conditions under which you operate are constantly evolving, and the markets that you serve are evolving too. Tax rules and regulations also change periodically. Therefore, it is beneficial to regularly consult your accountant to ensure your tax strategy continues to meet the needs of your business.

Maintain Accurate and Comprehensive Records

A Chartered Accountant will only be able to provide you with the best possible advice if they have accurate information. Therefore, it’s essential to maintain accurate records of all financial transactions. Remember also that financial records should be kept for at least six years.

Stay Informed About Tax Laws

You will extract maximum benefit from the tax advice you receive if you have a good level of understanding about business tax in Ireland, including corporation tax rates, VAT rates, PRSI, etc. A key part of this is staying on top of announcements and changes made by the government.

Optimise Your Business Structure

Review the structure of your business to ensure it not only meets operational needs, but also tax needs. Is the current structure the most tax-efficient for the circumstances of your business? This particularly applies if your business is going through a period of change, such as rapid growth or diversification.

Plan Proactively

You will get the best advice from your accountant if you have a clear idea of your future plans for the business. With this information, your accountant can give you tax advice that benefits you both today and in the future.

Ensure Compliance and Avoid Penalties

Even with the best tax advice available, your business can end up in a difficult position due to something as simple as missing a filing deadline. So, make sure your business meets its regulatory obligations to avoid fines, interest charges, and other implications of non-compliance.

Keep Your Business and Personal Finances Separate

It will be more difficult for an accountant to provide you with the best possible advice if there is confusion between your business and personal finances. It is always good practice to have them separated, including when optimising your tax position.

Optimising the Tax Position of Your Business

Optimising the tax position of your business ensures compliance and helps you take advantage of opportunities while avoiding risks. Getting the right tax advice is the best way to optimise your tax position.

Engaging a Chartered Accountant ensures the advice you receive is based on expertise and experience, while regular engagement will ensure the advice remains relevant. You will need to maintain comprehensive financial records while also staying informed about tax law. Planning proactively also helps.

These tips and the others in this blog will ensure you get the best tax advice for your business.

To speak to one of our accountants about the tax position and strategy of your business, get in touch with us at Gilroy Gannon.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.