Irish Company Formation Steps and Best Practices

Ireland is business-friendly, but there are steps you need to follow when setting up a new company. There are also Irish company formation best practices that will make the process as smooth as possible.

We are going to look at the main steps and best practices in this blog. However, this is a general guide, so please get in touch if you would like specific support and/or advice based on your circumstances and plans.

Irish Company Formation Steps

Step 1: Choose a Company Type and Name

As well as a name, you will need to choose an appropriate company type for your business. The most common company types when incorporating a business in Ireland are:

- Private company limited by shares (LTD)

- Company Limited by Guarantee (CLG)

- Private Unlimited Company (ULC)

| Company Type | Pros | Cons |

|---|---|---|

| Private company limited by shares (LTD) |

|

|

| Company Limited by Guarantee (CLG) |

|

|

| Private Unlimited Company (ULC) |

|

|

When choosing a business structure and company name, it is important to consider:

- Legal status and liability

- Ownership structure

- Management of the business

- Tax and accounting requirements

- Initial cost and sources of funding

- Growth potential

It is also important to consider the future at this stage of the process, especially the short- and medium-term future. While the structure and finances of your business might be simple today, they can get complicated quickly if you plan to seek investment or bring on new partners. Considering these plans at the company formation stage can reduce issues arising in the future.

Step 2: Appoint Officers

If you are setting up a LTD company, you will need at least one director plus a company secretary. If you have two or more directors, one of them can also be the company secretary. However, if you have just one director, the company secretary must be a third party – either another person or a company.

Normally, at least one director needs to be a resident of a country in the European Economic Area (EEA). If no director is an EEA resident, a Section 137 bond is often required.

CLG companies must have at least two directors, one of which can also be the company secretary. ULC companies must have at least two directors.

Step 3: Gather the Required Information

You will need specific information to register your business with the CRO – Ireland’s Companies Registration Office. This includes ID and address verification for all directors, shareholders, and the company secretary.

Step 4: Prepare Documents

Draft any necessary documentation, including the company constitution. Using an LTD company as an example, a company constitution typically includes the company’s name, registered office, share capital, directors’ powers/responsibilities, shareholder rights, procedures for shareholder and board meetings, and amendment procedures.

You will then need to complete and file Form A1 (Application to Register a Company). Supporting documentation will need to be included. Filing is usually done through the CRO’s CORE portal. For online applications, the fee is €50.

Step 5: Receive the Certificate

Depending on the complexity of your application and how you file it, the process can take anything from a few days to a few weeks. Once your application is approved, the CRO will issue a digital Certificate of Incorporation. You will also get your company registration number.

Irish Company Formation Best Practices

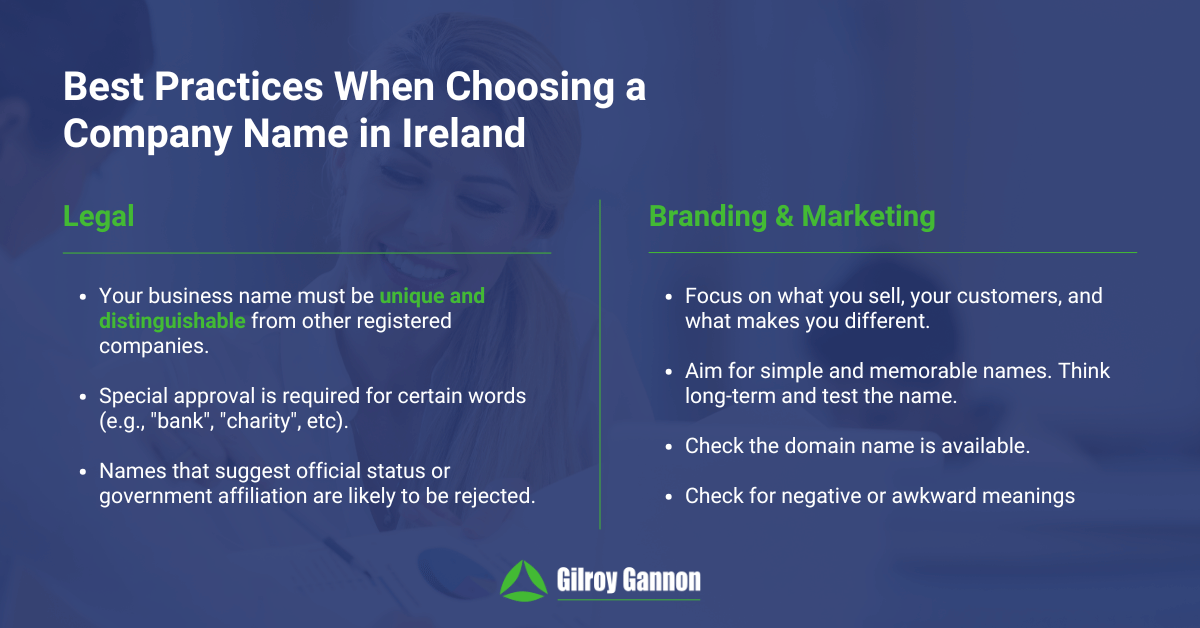

Name Availability

There are rules in Ireland about the names you can use for your company. The main rule is that your registered business name must be unique and distinguishable from other business names already in use. It is best practice to check the availability of your preferred name in advance to avoid delays when forming a business.

It’s important to note that there can be a difference between your registered business name and the day-to-day trading name of your company. The rules on company names relate to the registered business name.

It is also worthwhile considering the branding and marketing impact of your business name.

Business Address

There are two main types of addresses that apply to businesses registered in Ireland:

- Registered office – this is the address for official correspondence, including from the CRO. It must be a physical address in Ireland.

- Trading address – this is the address where the company’s activities will be carried out. It must also be in Ireland.

Your registered address and business/trading address can be different.

Company Secretary

It is beneficial to appoint your company secretary early in the process, especially if you are the sole director. If you don’t have anyone who can take on the role, there are corporate secretarial services available.

Constitution

For simple LTD companies, the option of using the CRO’s template constitution will save you time and money. However, for more complex structures and businesses, it is best to get professional advice and support to draft your constitution.

Bank Account

Open a business bank account to keep the new company’s finances separate from personal and other finances.

Timely Filing

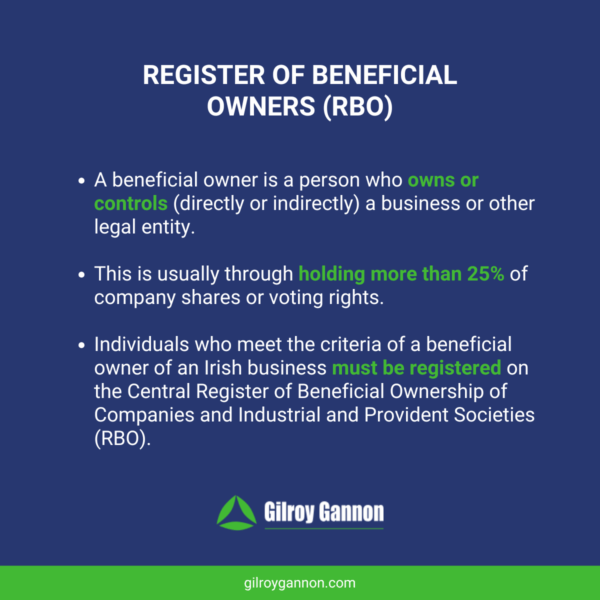

There are a number of post-incorporation tasks that you will need to take care of, including beneficial ownership registration and registering for tax (e.g., corporation tax, VAT, etc). Make sure you complete these tasks according to statutory deadlines.

There are then annual accounting requirements you will need to comply with, including keeping up-to-date accounting records, preparing financial statements, and filing annual returns with the CRO.

Irish Company Formation Support at Gilroy Gannon

At Gilroy Gannon, we can guide you through the company formation process in Ireland to ensure your business is properly established. We offer a comprehensive and tailored service with expertise in all types of companies, from the straightforward to the highly complex. Get in touch today to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.