Guide to Filing VAT Returns in Ireland

Navigating VAT compliance in Ireland involves keeping good records, getting your calculations right, and filing your VAT returns on time. As your business scales, transitioning from registration to the regular filing of VAT returns is a critical component of corporate governance.

Our guide to filing VAT returns in Ireland gives you an overview of the process, including the key requirements, filing deadlines, common mistakes to avoid, and the main elements of a VAT return filing.

Key Requirements for Filing VAT Returns in Ireland

VAT Registration

You must register for VAT if your annual turnover exceeds the relevant threshold. The main VAT registration thresholds are €42,500 for services and €85,000 for goods. Even if your turnover is less than the relevant threshold, you can still elect to register for VAT. Read more about VAT registration in our blog.

ROS

In most cases, you will use the Revenue Online Service (ROS) to file VAT returns. If not already done so, you will need to register for ROS.

Requirement to File

It is mandatory to file a VAT return for each taxable period if you are registered for VAT. In other words, once you are VAT registered, you need to file returns even if you haven’t started trading.

Record-Keeping

It is essential to keep accurate, detailed, and complete records of sales and purchases, including VAT invoices. These are necessary to ensure your VAT returns are accurate and you pay the right amount of VAT.

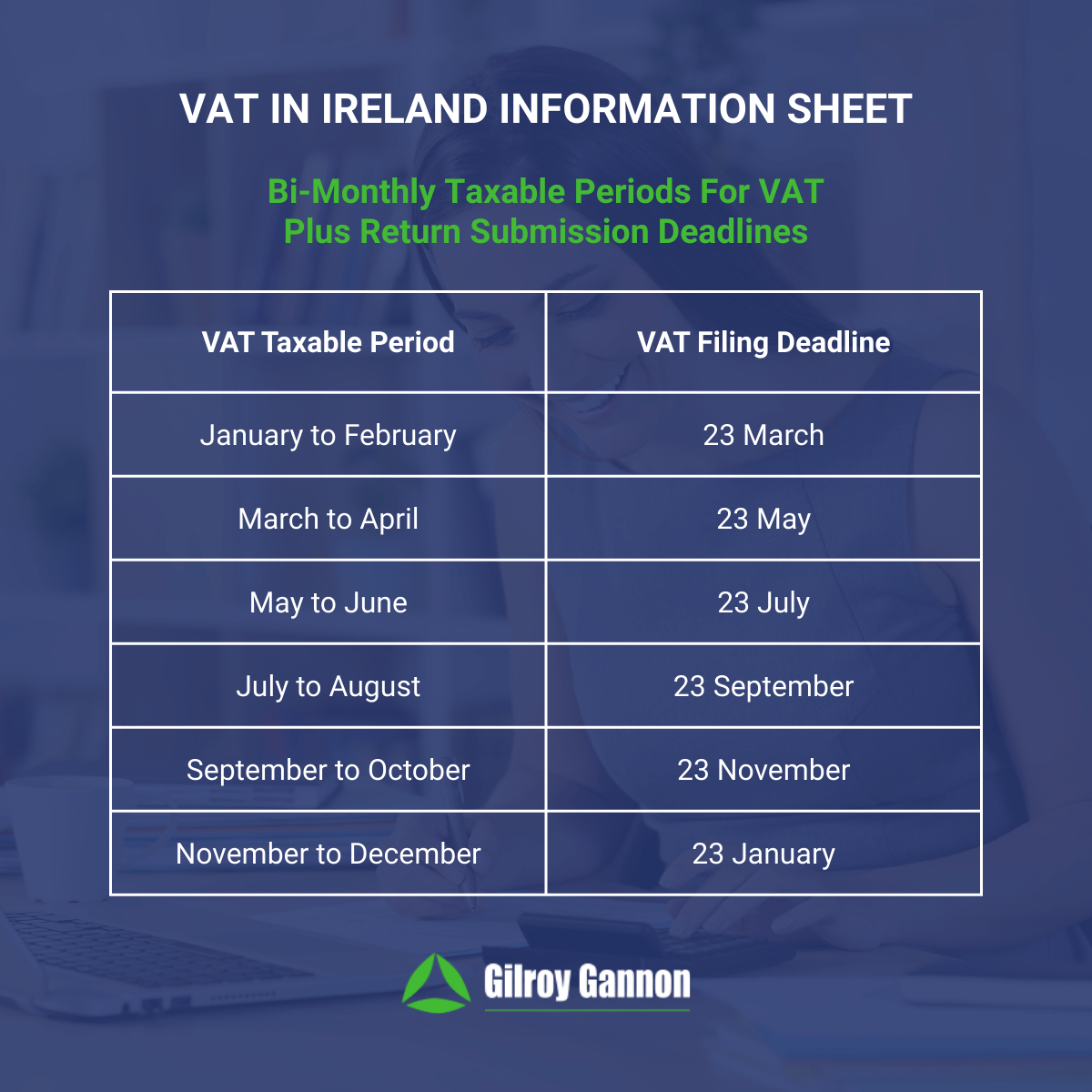

VAT Return Frequencies and Submission Deadlines

Most businesses in Ireland file VAT returns bi-monthly (every two months). There are some exceptions, including:

- Every four months – you will file every four months if your annual VAT liability is between €3,001 and €14,400.

- Every six months – you will file every six months if your annual VAT liability is €3,000 or less.

If you file your VAT return using ROS, the deadline for submission and payment of your VAT liability is the 23rd day of the month following the end of the taxable period. The deadline for paper returns is the 19th of the month, although paper returns are increasingly uncommon.

Taxable periods run in two-month blocks if you file VAT returns bi-monthly. For example, you will need to file your return and pay VAT on the 23 March for the two-month taxable period from the first day in January to the last day in February.

What You Need to Know

Filing a VAT return means completing a form known as a VAT 3. Here is a brief summary of the main parts of the VAT 3 form:

| VAT 3 Form Field | Description |

|---|---|

| T1 – VAT on sales | This is the VAT you charged customers on the sales of your goods and/or services. It also includes other elements in some circumstances, such as EU purchases and imports. |

| T2 – VAT on purchases | This is the VAT you have paid on the purchase of goods and services for your business. As with VAT on sales, it also includes EU purchases and imports. |

| T3 – VAT payable | If T1 (the VAT you have collected from sales) is greater than T2 (the amount of VAT you have paid on purchases), this is the amount of VAT that you owe. The calculation is T1 – T2. |

| T4 – VAT repayable | If T1 is less than T2, this is the amount of VAT the Revenue owes to you. The calculation is T2 – T1. |

There are also additional fields on the VAT 3 form if you have traded with organizations in other EU countries.

| VAT 3 Form Field | Description |

|---|---|

| E1 – Intra-EU supplies of goods | The value of goods you have sold to customers in the EU. |

| E2 – Intra-EU acquisition of goods | The value of goods you have bought from suppliers/vendors in the EU. |

| ES1 – Intra-EU supply of service | The value of services you have sold to customers in the EU. |

| ES2 – Intra-EU acquisition of services | The value of services you have purchased from suppliers/vendors in the EU. |

| PA1 – Postponed Accounting | The value of goods you have imported under Postponed Accounting. |

Common VAT Return Mistakes to Avoid

- Using the wrong VAT rates, so verify the correct rate to use. Read our blog explaining Ireland’s VAT rates.

- Filing late, so keep on top of deadlines to avoid penalties.

- Entering incorrect figures, so double-check everything for accuracy.

- Leaving out transactions from the period in question, so check everything is included and make sure you understand the VAT claims you are entitled to.

- Poor record-keeping, so make sure you stay organized and on top of recording your sales and purchases.

Managing VAT Returns

Managing VAT returns is an essential task for most businesses in Ireland. Keeping up-to-date and complete records is a daily task, calculations have to be completed accurately, and you must file your VAT return and pay any VAT that you owe on time.

We can help with any part of the process, from helping you register for VAT to giving advice on the correct VAT rate to use to managing the filing of your VAT returns. Contact us today to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.