Requirements for Starting a Business in Ireland

Whether you are launching a homegrown startup or setting up a base here, Ireland is an attractive place to establish and run a business. What are the requirements for starting a business in Ireland, what are the steps you need to take, and what should you be aware of?

There are a number of considerations you should think about when starting a business, including market research, finding the right employees, and developing a strategy for finding customers and winning orders. In this blog, however, we are going to focus on the practicalities of starting a business in Ireland.

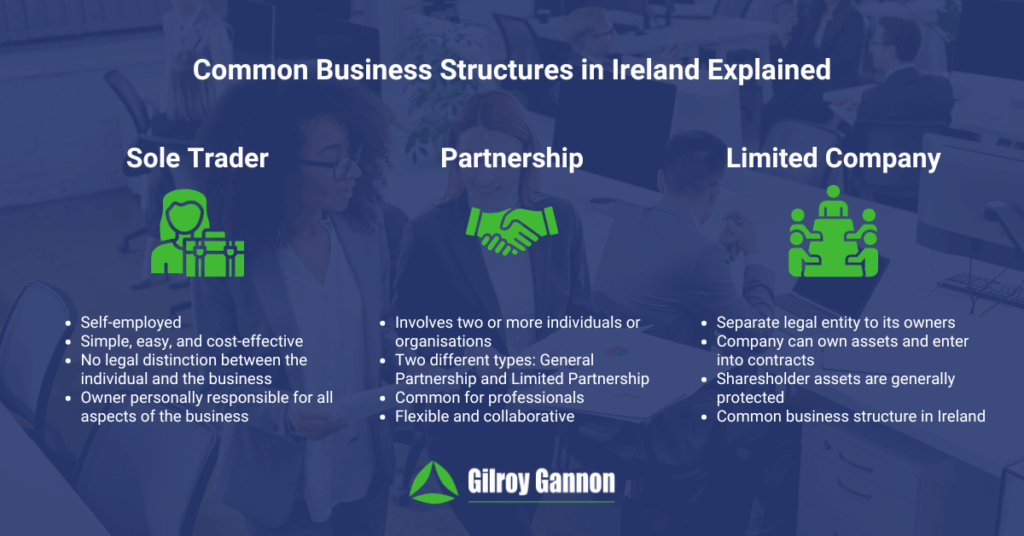

Choose a Business Structure

There are three main types of structure used by businesses in Ireland:

- Sole trader

- Partnership

- Limited company

Limited companies are the most common. As a result, a lot of the points and recommendations in this blog are most relevant to limited companies.

Register Your Business

Limited companies must be registered with the Companies Registration Office (CRO). You will need to provide a number of documents when registering your business with the CRO, including details of directors and shareholders.

In some situations, sole traders and general partnerships also need to register with the CRO:

- If you are a sole trader and operate under a name different from your own, you will need to register the business name with the CRO.

- If you are a general partnership and trade under a business name that is different from your or your partners’ names, you will need to register the business name with the CRO.

The CRO operates an online system, known as CORE, for business and business name registration.

Register for Taxes

You will need to register your business with the Revenue for tax purposes. This includes corporation tax, but you may also have to register for VAT, and you may need to pay preliminary tax. Getting advice from a chartered accountant will help ensure you meet your tax registration obligations.

If you are hiring employees, you will also need to register for PAYE (Pay As You Go) tax and PRSI (Pay Related Social Insurance).

Create a Business Plan

Business plans are not an absolute requirement for starting a business in Ireland. For example, business plans are not necessary to register your business with the CRO. However, at Gilroy Gannon, we believe business plans are critical, so it’s important they are included in this blog.

Decide on a Unique Company Name

The company name you choose must be unique and distinguishable from other companies registered in Ireland. There are also other points to consider:

- Certain words, such as “bank” and “group”, require special approval

- Some words don’t count when assessing whether a name is unique. Examples include “services”, “Ireland”, and “solutions”. So, you probably won’t be able to register “<business-name> Solutions” if there is a “<business-name> Services” already registered

- Business names can be refused for other reasons as well, such as if the name is believed to be offensive.

You should also think about your presence online when choosing a name for your business. Can you get the website address that you want, for example, and will the website address be recognisable or memorable?

Funding

Most businesses require funding to get going. Funding options include:

- Investments by directors and shareholders

- Bank loans

- Loans from other commercial finance providers

- Loans from company directors

Grants and loans might also be available from Local Enterprise Offices (LEOs), Enterprise Ireland, and other Government bodies and schemes. For example, Microfinance Ireland is a government-backed small business cashflow loan scheme administered through LEOs around the country.

Registered Office

All Irish companies need a registered office in Ireland. The trading location of the company and the registered office do not need to be the same address.

Directors

Limited companies in Ireland need at least one director. Normally, at least one of the company’s directors must be resident in the European Economic Area, although there is a process where non-resident directors can be approved. This is known as a Section 137 Non-Resident Directors’ Bond.

All directors of the company will need a personal public service number (PPSN) that must be supplied to the CRO.

Directors of your company must also understand their obligations and responsibilities under Irish law.

Company Constitution

Irish companies need a Company Constitution, a legal document outlining how your company will be run.

Company Secretary

Irish companies must have a company secretary. This can be one of the directors, another individual, or a company that provides company secretarial services.

Business Bank Account

It is essential to separate personal and business finances, so opening a business bank account is an important step in starting a business in Ireland.

Insurance

Business insurance is often recommended for companies in Ireland and, in some cases, it’s a legal requirement. Common types of insurance include employers’ liability insurance, public liability insurance, and commercial property insurance.

Permits and Licenses

Depending on your business, you might need to obtain certain permits or licenses. Common examples include property change of use, health and safety permits, etc.

Beneficial Ownership Registration

Each person, including directors and shareholders, who owns more than 25 percent of your company must register with the Register of Beneficial Owners, also known as the RBO.

Understanding Your Responsibilities

Starting a business brings with it a number of responsibilities and obligations. This includes responsibilities and obligations as a director.

It is also important to understand your tax and filing responsibilities, including filing annual returns with the CRO, submitting tax returns to the Revenue, and paying your taxes on time.

If you plan to employ staff, understanding your responsibilities as an employer is important too. This includes understanding employment contracts, minimum wage, PAYE, PRSI, payslips, holidays, health and safety, data protection, and more.

Business Support

With our experience working with businesses setting up in Ireland, from new start-ups taking their first steps to international corporations establishing an Irish presence, we believe getting the right support is essential. Legal, financial, accounting, business, and tax support are among the most important.

This is where we can help at Gilroy Gannon, especially in the finance, accounting, and business advice areas of starting a business in Ireland.

Summary: Starting a Business in Ireland

Starting a business in Ireland involves a number of elements:

- Choosing a structure

- Choosing a business name and registering with the CRO

- Registering for taxes

- Creating a business plan

- Getting sufficient funding in place

- And more

We can help at Gilroy Gannon. Contact us today to arrange a consultation with a member of our team.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.