9 Tips for SME Accounting in Ireland

For small and medium-sized enterprises (SMEs) in Ireland, accounting should be more than a routine task or, let’s be honest, a headache. Accounting is, in fact, the foundation upon which you can build business growth and long-term success. Good accounting practices empower you as a business owner or senior executive, enhancing your ability to track financial performance, make informed decisions, and meet regulatory requirements.

Whether you are running a business in a start-up phase or managing an established SME, it is essential to be on top of accounting best practices in Ireland.

In this blog, we’ll share nine practical tips that will help you streamline your finances, optimise accounting efficiency, stay compliant, and set your business on the path to sustainable growth.

1. Maintain Accurate and Up-to-Date Records

Financial records are a must-have for SME accounting in Ireland. Therefore, it’s important you keep detailed records of all transactions, including invoices, receipts, and bank statements. This is essential for compliance and to understand the financial health of your company.

It is especially important to maintain accurate and up-to-date records when trading in cash, as well as during busy periods when it is more difficult to stay on top of record-keeping.

2. Separate Business and Personal Finances

This tip especially applies to start-ups, but some more established businesses could also benefit. You should always, always, always keep your business and personal finances separate. This means opening a dedicated business bank account if you don’t have one and never mixing personal and business expenses.

3. Embrace Accounting Software

Cloud-based accounting platforms automate and semi-automate essential tasks such as invoicing, expense tracking, and reporting. This saves time, helps keep accounting records up-to-date, and reduces errors.

4. Stay on Top of Tax Obligations

A key part of SME accounting, and running a business more generally, is understanding and complying with Irish tax and company requirements. This includes VAT, corporation tax, and PRSI (pay related social insurance).

Part of staying on top of your tax obligations involves filing your tax returns on time to avoid penalties and maintain a good standing with the Revenue.

Meeting your tax obligations is not just about compliance, however, as you might also be able to take advantage of tax incentives or reliefs to reduce your tax liability. Examples include R&D tax credits and capital allowances, although it’s important to note there are rules and criteria you must meet to qualify.

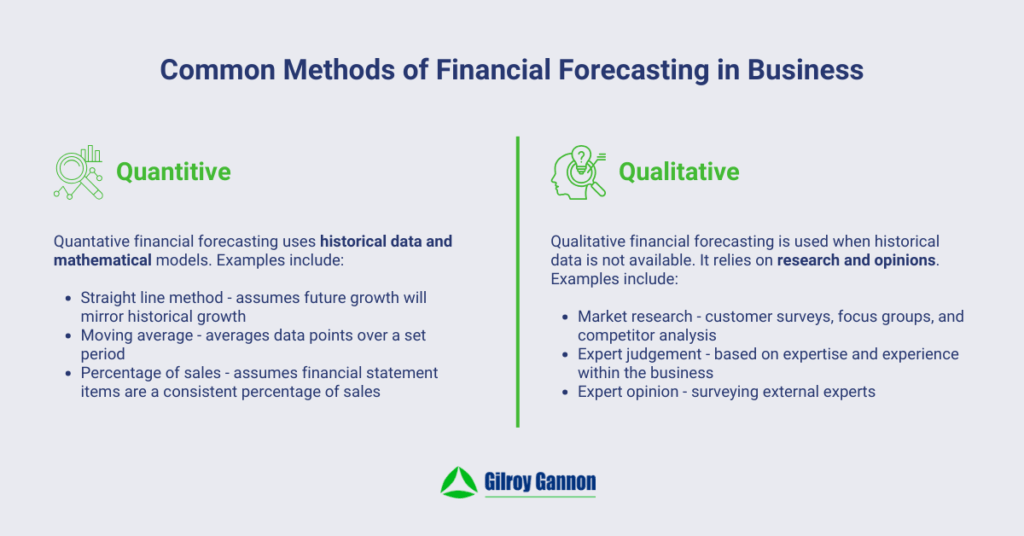

5. Budget and Forecast Regularly

Budgeting and forecasting are about more than estimating where your business might be at some point in the future. It is also about scenario planning, enabling you to better prepare for uncertainties and decide on the areas of your business that would benefit most from investment.

It is not an easy or scientific process, as factors outside of your control can quickly and unexpectedly change expenses and revenue. That said, budgeting and forecasting remain important exercises to undertake.

6. Monitor and Manage Cash Flow

Cash flow is important in all businesses, so you should track it regularly (weekly or monthly), not least to identify potential issues early.

It is also beneficial to review and optimise the payment terms you have with both customers and suppliers to help you maintain healthy cash reserves.

7. Seek Professional Guidance

Many of the items on this list are complex, time-consuming, require specific expertise, or are a combination of all three. When accounting becomes complex, takes up too much time, or you require specific expertise, it makes sense to seek professional guidance from an accountant.

8. Take Steps to Overcome Common Accounting Challenges Faced by SMEs in Ireland

You will also benefit from understanding the common accounting challenges faced by SMEs in Ireland, so you can take steps to avoid or mitigate them. Those challenges include:

- Finding time for bookkeeping, forecasting, analysing, and other accounting tasks

- Identifying and engaging the right accountant for the needs of your business

- Making sure personal and business finances stay completely separate

- Meeting tax and compliance deadlines

- Choosing the right accounting software for your needs

9. Be Proactive

Finally, stay proactive, as accounting should be a value-adding exercise in your business. With good SME accounting practices, you can save money, reduce operational and financial risks, improve decision-making, and drive business growth.

Conclusion: Enhance Business Performance Through SME Accounting Best Practices

Effective accounting is at the heart of every successful SME in Ireland. Maintaining up-to-date records, clearly separating business and personal finances, and staying on top of your tax obligations ensures compliance and facilitates informed decision-making.

Regular forecasting and vigilant cash flow management will help you anticipate challenges and take advantage of opportunities, while seeking professional advice will ensure you are equipped to navigate complex regulations with an optimised financial strategy.

This is where we can help at Gilroy Gannon, whether you need practical support, general guidance, or advice in a specialist area. Get in touch today to arrange a consultation.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.